Managing a vehicle fleet isn’t easy, from dealing with everyday problems to ensuring the logistical needs of the business are being met, especially in a period of growth. The company may not be able to run the fleet at its optimum level from a cost and tax perspective, and risks non-compliance by not keeping proper records or paying the right amount of tax.

Today, we’re going to look at a business mileage tracking case study in the UK. HMRC views mileage as a high-risk area and would evaluate how the company deals with business and personal mileage by reviewing its systems, processes, and controls.

The company would be expected to substantiate any mileage claimed. For example, date, where from, location, and why the travel was taken.

This is onerous and takes time from both an employee’s and employer’s point of view. A manual system is inaccurate, inefficient, and time-consuming for the company as a whole.

Mileage Tracking Case Study in the UK

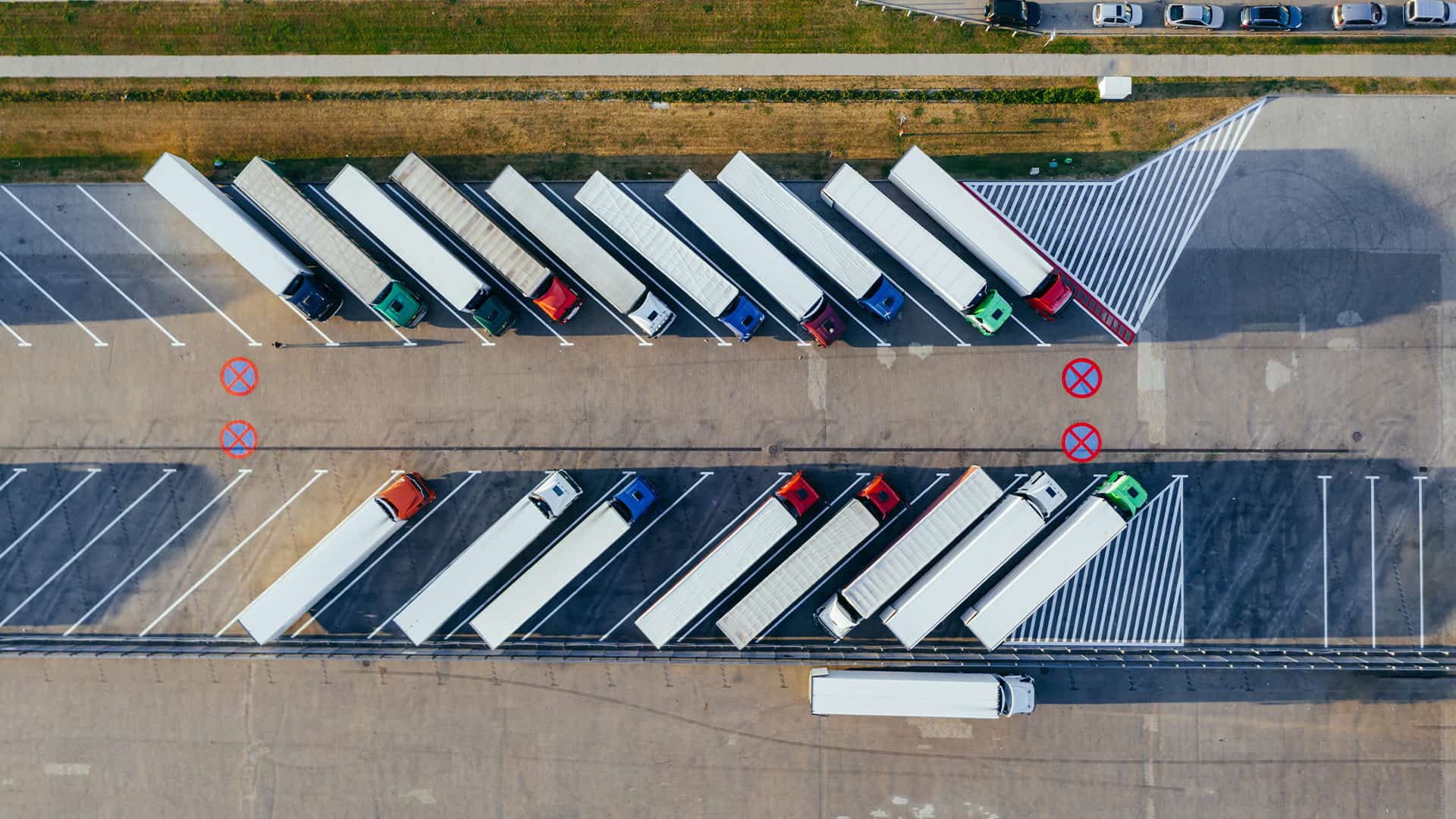

Supermarket Ltd has a fleet of 500 lorries where mileage is paid by fuel cards. It has 500 company cars paid by fuel cards with different engine sizes and fuel (electric/petrol/diesel), and on average reimburses 500 employees for business mileage on a monthly basis, and relies on employees to mark personal travel, which many fail to do.

Related: Issues With Claiming Business Mileage in the UK

Currently, it doesn’t require employees to keep a log of business miles and reimburses employees who have personal cars through spreadsheets. It also has come to the finance department’s attention that personal car owners may have overclaimed when submitting expense claims.

It is also concerning when company car owners use their cars for personal use but don’t declare it, which may result in additional work as well as an increase in tax for the employee and employer. The company cannot cope with the volume of 1500 vehicles, especially with the monthly VAT submissions and dealing with different engine sizes and fuel types as the advisory fuel rates change monthly.

In addition, the P11d process is cumbersome and a lot of the time is trying to find out information on car value, engine size, etc. Furthermore, the company’s management team is seeing increased fines for speeding and accidents. The company has outlined these issues below.

Current Problems

1) HMRC requires substantiating every business mile, even those spent on fuel cards. They cannot automatically assume all miles are business-related.

2) Manually claiming VAT on mileage based on advisory fuel rates with added complexity as VAT claims depend on engine size and type of fuel, as well as the month, where the advisory fuel rates on fuel may change.

There is also the risk of claiming VAT on private fuel and ending up with a scale charge. Employees send in fuel receipts, which means more paperwork.

3) They run the risk of having the wrong mileage rate being used which will result in increased costs as employees may claim, for instance, 0.45p, when the correct rate should be 0.25p. If they pay more than the Approved Mileage Allowance Payment rate, then it becomes taxable on the P11d.

4) Unable to determine private journeys, therefore increasing costs and risk of fuel benefit charges on the employee. Employees may be going on private trips on company’s time, which is a double whammy.

5) Possible risk of fraud from those with personal vehicles by claiming for fictitious journeys or claiming additional miles. Rounding up trips seems common, and inadvertent claims for private trips like going from home to a contracted workplace or stopping en-route for private activities can also occur.

6) No KPI data available, like cost per mile or analyzing data on route optimization.

7) Cannot monitor drivers behavior.

8) Cannot track whereabouts of vehicles.

Related: How To Know if You Qualify for Mileage Claim in the UK

Company Decides to Install Business Mileage Tracking Device

1) Mileage is captured automatically to and from, as well as the number of miles. Employees can add information and mark their private journeys as needed. It can also upload fuel receipts.

2) Company deducts personal mileage from the salary of the employee so there is no fuel benefit or VAT scale charge.

3) Facilitates VAT claims as the finance department can download a report with the VAT calculated on fuel base, amount of fuel used, engine size, and month.

4) Data, when available, can check for obvious errors and fraud. For instance, home to a place of work claims or private trips.

5) KPI data available to reduce costs. Able to monitor the length of journeys and miles, thereby reducing costs by advising the driver of the optimum routes to take in the future. Cost per mile analysis, including why the journey is taking longer or costing too much.

6) Track vehicles and help logistics, as well as reduce time for deliveries. Improved utilization of employee time.

7) Analyze driver’s mileage consumption and encourage better driving to lower fuel costs.

8) Monitor driver’s behaviors, including speeding. Speeding can increase the likelihood of accidents and fines.

9) Lower fuel costs will result in reduced CO2 emissions.

10) VAT receipts are stored electronically rather than dealing with thousands of receipts.

Costs Saving For Mileage Tracking Expense

- Lorry travels 100,000 miles per annum

- Company car 35,000 miles per annum

- Personal cars 20,000 miles per annum

- Lorries = 500 * 100,000 * 5% * £0.55 = £1,375,000

- Company Cars =500 * 35,000 * 5% * 0.15 = £131,250

- Personal Cars = 500 * 20,000 * 10% * 0.45 = £450,000

- Employee Fuel Benefit NI = 500 * £1000 = £500,000

Reason for Cost Savings

1) Better driving and optimal route maximization.

2) Personal travel detection and reimbursement.

3) Overclaim on mileage through rounding.

4) Incorrect mileage rate.

5) Accurate data less likely for additional tax, e.g. VAT Fuel Scale Charge.

Other Costs

1) Employees fuel benefit charge.

2) HMRC fines of £3,000 for not keeping proper records and risk of a detailed audit, with penalties up to 30% for tax unpaid and deemed to be careless.

Time

1) Checking and Approving Mileage Claims.

2) Working out VAT element manually including checking VAT Receipts 3) Personal Travel Reimbursement

4) P11d submissions including Fuel Benefit Charge

5) Improved utilisation of company time (personal travel/idle time)

Average 5 days a month for 1 Finance Staff: £200 * 5 = £1000 per month. Annual = £12,000 Average 2 day a month for Management: £500 per month Annual = £6,000

Employees spending two days a month equivalent logging business mileage = £250 * 2 = £500 : Annual £6000

Employee utilising company time for personal trips: 1 day a month = £250 * 1 = £250: Annual = £3000

Total Savings: £2,500,000

Automated Mileage Tracking System

A company mileage tracking solution system is essential for any business. The possible savings for a large company are significant and definitely cannot be ignored.

In the above case study, which is based on conservative estimates, the company could save a whopping £8.5m. Studies have shown that 47% of employees overclaim on business mileage, we have just taken a figure of 10%.

For lorries, we have only taken 5% in savings. They are unlikely to have any personal travel expenses, but the main savings will be through route optimizations, driving behavior changes, and proper employee utilizations.

For company cars, we have taken 5% savings as the likelihood of private travel, which is considered to be high. Again, route optimizations and driving behavior changes will be important factors in lowering costs.

Main Benefits Summary

1) Innovative approach and reduced expense cycle. Mileage data can be integrated into the expense claim system and paid accordingly.

Personal mileage cost recovery can be integrated with payroll. Mileage can be automatically submitted to the accounts software by the press of a button.

2) Save both employee and employer administrative time.

3) Lower fuel costs.

4) Reduction in fraud.

5) Recovery of personal mileage.

6) Data availability and analysis with KPIs.

7) Lower CO2 emissions.

8) Improved driver behavior and reduced risk of fines and accidents.

9) Accurate VAT returns and maximized claims.

10) HMRC compliant and less likely to result in extensive audits and penalties.

11) Tracking of vehicles to increase efficiency.

12) Reduced taxes; for instance, the VAT scale charge.

13) Better reporting; for instance, VAT on fuel on one singular report, rather than dealing with having to collate multiple spreadsheets. There are other useful reports for personal mileage recovery and for P11d filing.

14) Save paper/postage, as VAT receipts held electronically.

Conclusion

Mileage reimbursement coupled with an automatic mileage tracker app can be a powerful tool to save companies time and money. Try out our mileage reimbursement calculator to see how much you can save or visit our pricing page to learn more. You can also schedule a complimentary live web demo here.