* This table compares the full feature plans of TripLog, MileIQ, Everlance, and QuickBooks Self Employed.

- Products

Mileage

Expense

Time

Mileage

Expense

Time

- PartnersLearn more

Book a call with our experts

Book a call with our expertsDiscover how TripLog can drive time and cost savings for your company.

- SolutionsSolutions

TripLog is the market’s premier mileage and expense tracking solution. We cater to businesses of all sizes and industries.

Find out how much your company can save: - ResourcesTools

Learn about new features, tips & tricks, and how people have used TripLog to save thousands of dollars and man-hours.

Essential Reading:Resources - Pricing

- What’s new

Automatic Mileage Tracking Made Easy

TripLog’s truly free unlimited automatic mileage tracking helps you stress less and keep more of what you earn. Get started for free!

Have multiple users? Explore our multi-user plans.

Use Our Mileage Deduction Calculator To Find Out How Much You Could Save

2025 Mileage Tax Deduction Calculator

Annual Mileage Tax Deduction

$7,665.00

*Simple cents-per-mile reimbursement is just one of the mileage programs we offer at TripLog. We specialize in all IRS compliant mileage programs including Car Allowance, Smart Mileage Rate, Fuel Cards, and Fixed and Variable Rates.

NO LIMITS

Free Unlimited Automatic Trip Detection

Never worry about manually starting or stopping your mileage tracker again. The TripLog app lets you automatically track your mileage, capturing every business drive without limits, giving you accurate records for tax time – all completely free.

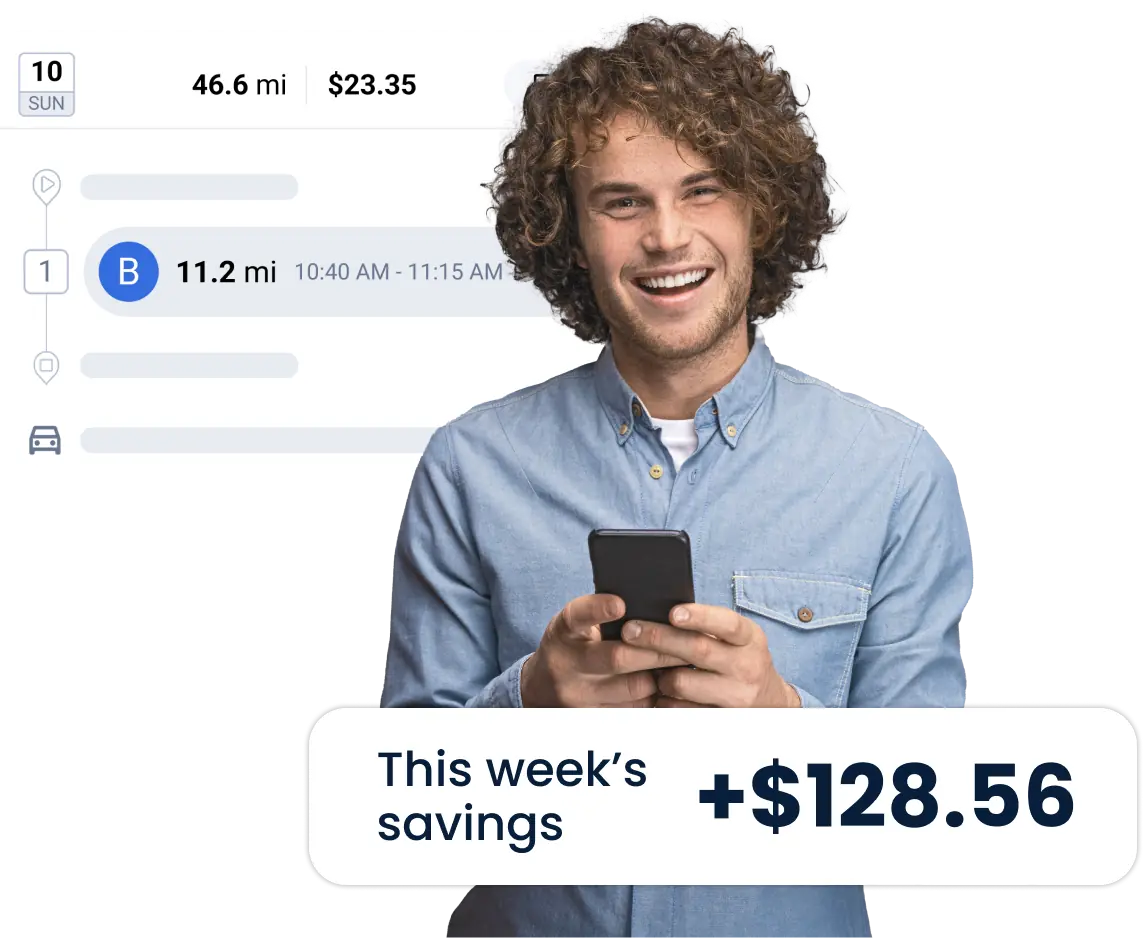

AUTO START

Never Miss a Trip Again

With six different mileage tracking options, TripLog lets you choose the method that best fits your unique needs. With our free unlimited auto-start options, TripLog starts tracking when you start driving, ensuring you never miss a deductible or reimbursable mile again!

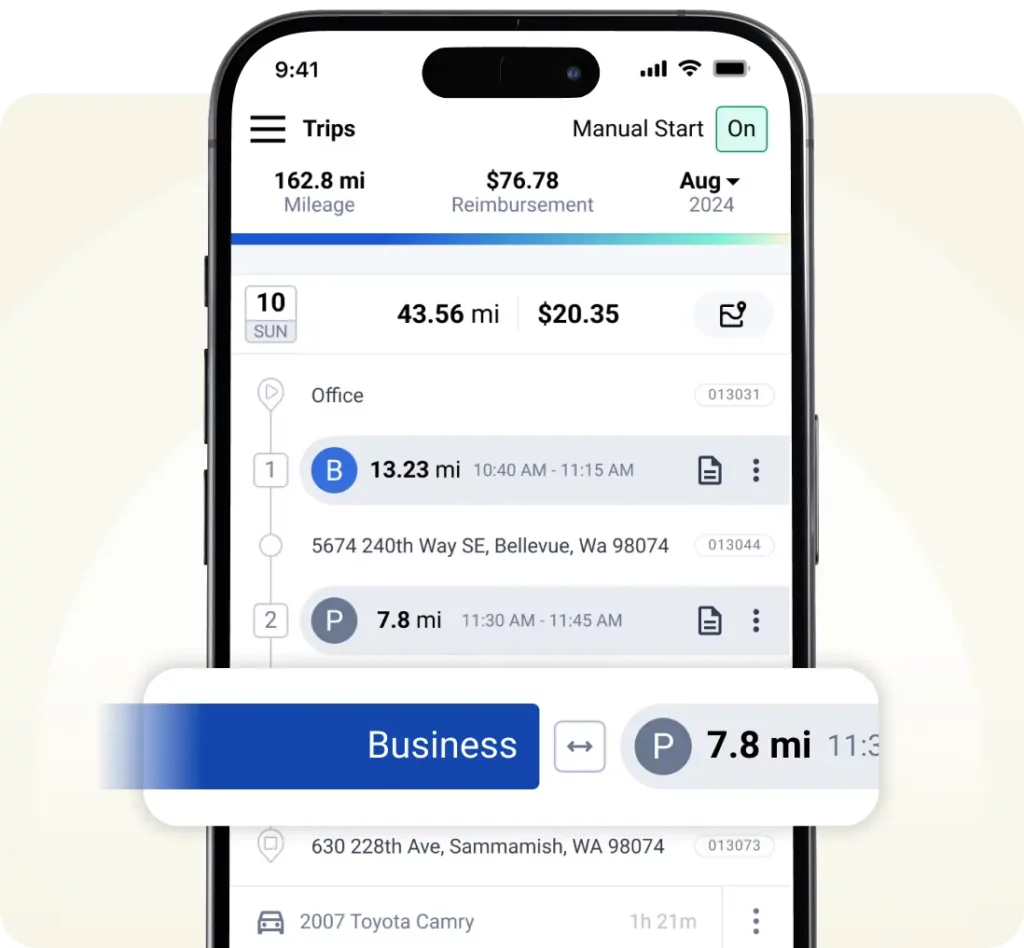

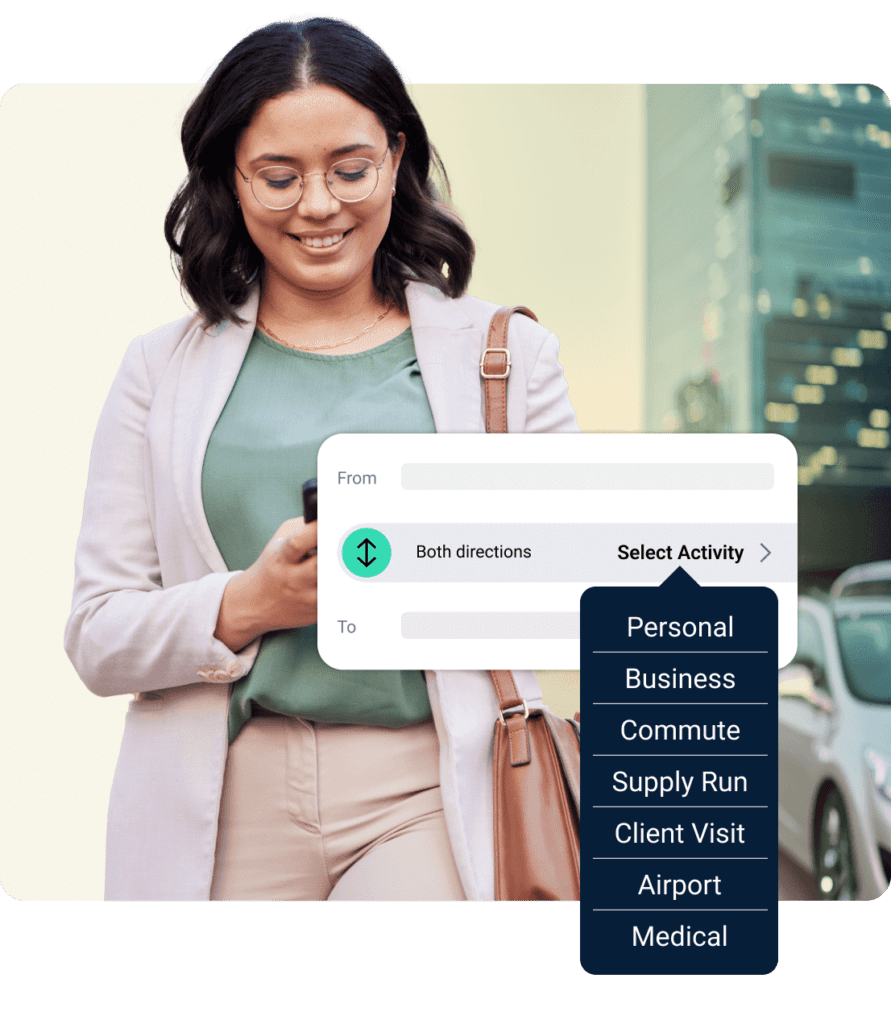

CATEGORIZE

Easily Classify Your Trips

TripLog allows you to easily classify which of your drives are business or personal – all it takes is one swipe.

You can also set your work hours to automatically categorize your trips based on your workweek or schedule. Personal trips are always private and are only shared when you want them to be.

The Best Mileage Tracking App

Feature Comparison Table

See how TripLog stacks up against some of the other top mileage tracking apps.

| TripLog | MileIQ | Everlance | Driversnote |

|---|

| Free Plan | ||||

|---|---|---|---|---|

| Unlimited automatic mileage tracking | YES | -- | -- | -- |

| Manual mileage tracking | YES | -- | YES | YES |

| Fuel tracking and MPG calculation | YES | -- | -- | -- |

| Daily trips map view | YES | -- | -- | -- |

| Income and expense tracking | YES | -- | YES | -- |

| Paid Plan | ||||

| Monthly pricing for single user | $5.99 | $8.99 | $8.99 | $11 |

| OCR receipt capture | YES | -- | -- | -- |

| Concur integration | YES | YES | -- | -- |

| Web app access | YES | YES | YES | YES |

| Bank & credit card integration | YES | -- | YES | -- |

| Frequent Trips - Location Based Classification Rules | YES | YES | -- | -- |

| Route Planning | YES | -- | -- | -- |

| Custom activities and mileage rates | YES | -- | YES | -- |

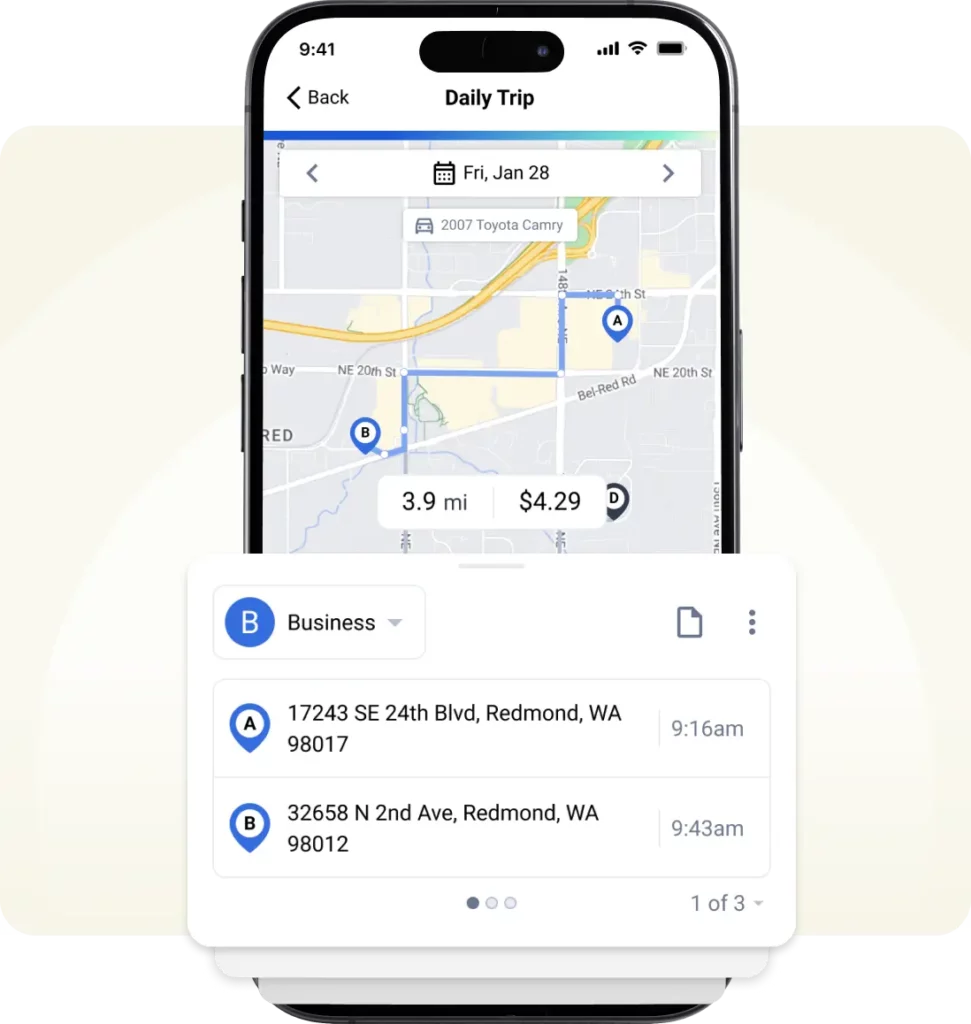

REVIEW & PLAN

Daily Trip View + Route Planning

With Daily Trip Journey’s map view, you can easily see a summary of your trips for the day, with an easy one-touch classification of locations and purposes. TripLog also lets you plan your routes for an upcoming workday.

SAVE TIME

Streamline Your Mileage Tracking With Frequent Trip Rules

If you commonly make trips between specific locations, TripLog’s mileage tracker app lets you set Frequent Trip Rules, allowing you to categorize them ahead of time. You can also set favorites, create activities, and more.

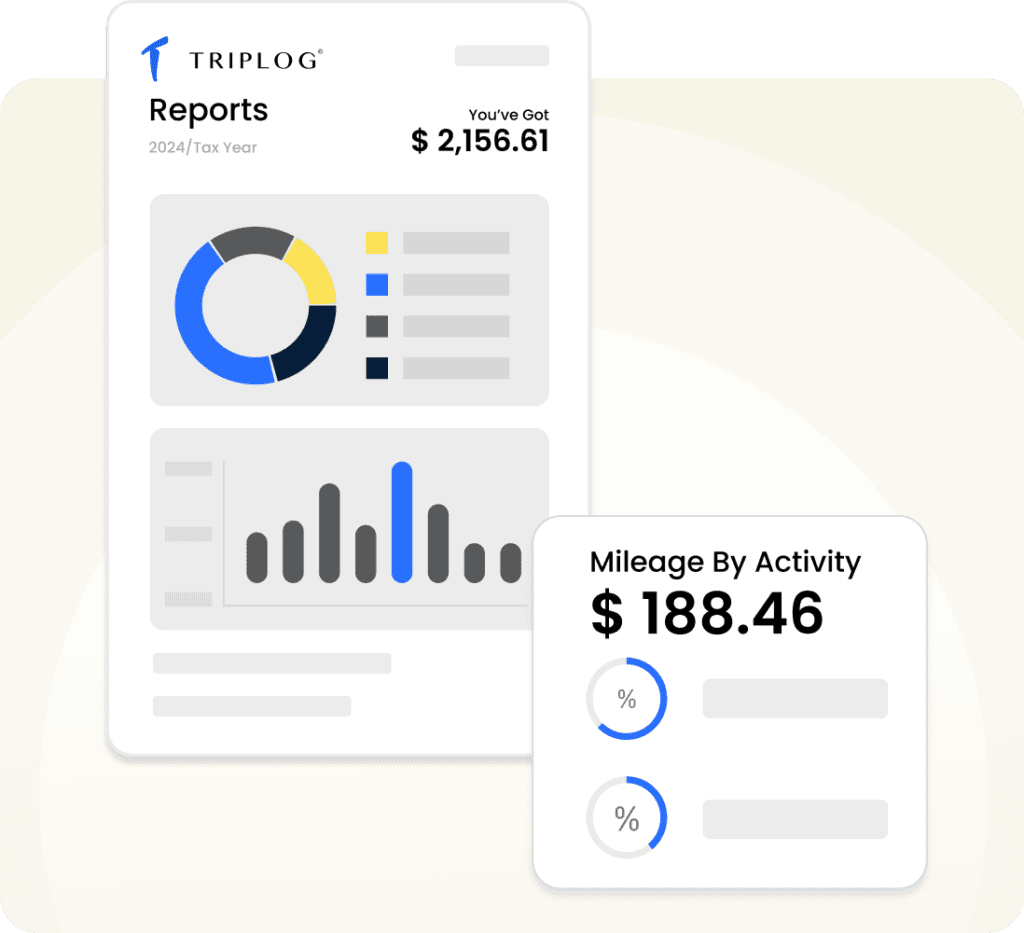

NEVER MISS OUT ON A DOLLAR

Tax-Compliant Mileage Reports

TripLog’s detailed reports make it easy to maximize your tax deductions or reimbursements. Basic plan users can use their annual 7-day Premium Pass to access their annual report.

For unlimited reporting year-round, as well as other powerful features, explore TripLog Premium!

QUICK. EASY. PRECISE.

Fuel Tracking

With TripLog, it couldn’t be simpler to track your fuel purchases. You can enter what you spend manually, or simply take a photo of your gas receipt and our app’s OCR* capabilities will fill in the rest.

*Premium feature only