- Products

Mileage

Expense

Time

Mileage

Expense

Time

- PartnersLearn more

Book a call with our experts

Book a call with our expertsDiscover how TripLog can drive time and cost savings for your company.

- SolutionsSolutions

TripLog is the market’s premier mileage and expense tracking solution. We cater to businesses of all sizes and industries.

Find out how much your company can save: - ResourcesTools

Learn about new features, tips & tricks, and how people have used TripLog to save thousands of dollars and man-hours.

Essential Reading:Resources - Pricing

- What’s new

TripLog Mileage

Resource Center

This resource center is a place for companies with mobile employees as well as independent contractors to find useful tools, articles, and downloadable content to help their businesses succeed.

Table of Contents

DOWNLOADS, GUIDES, & MORE

Company Mileage Toolkit

Why Companies Need A Mileage Reimbursement Solution

TripLog ROI Case Study White Paper

TripLog Mileage

Policy Handbook

Sample Mileage

Reimbursement Policy

LEARN ABOUT RULES & REGULATIONS

Compliance

Mileage Reimbursement

Requirements By State

Which States Require

Expense Reimbursement

Company Mileage

Reimbursement Guide

Fixed and Variable Rate Reimbursement Explained (FAVR)

YOUR COMPANY COULD BE LOSING THOUSANDS

Over-Reported Mileage Explained

Your Drivers May Be Overreporting Mileage By 28%

Over-Reported Mileage Infographic

IRS Mileage Guide

Start saving thousands with

the #1 automatic mileage tracker

FREE DOWNLOADS

Mileage Log Templates

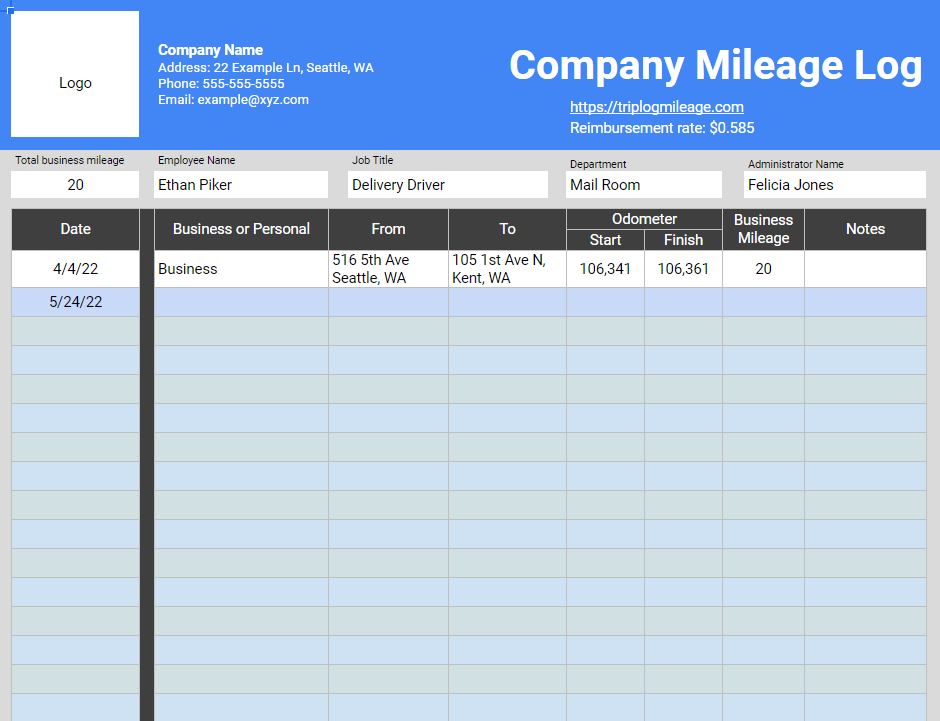

Company Mileage Log

Template Download

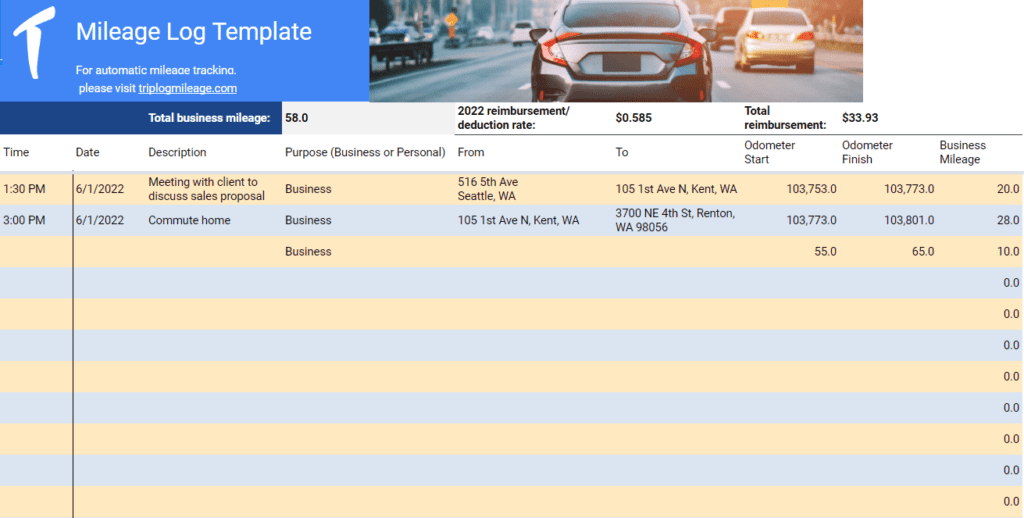

Self-employed Mileage Log

Template Download

LEARN HOW MUCH YOU COULD BE SAVING

Tax Calculators

Mileage Reimbursement Calculator

1099 Tax Calculator [External Link]

2023 IRS Business Mileage Rate Explained

Get back eight hours

each month

per driver!

LEARN MORE ABOUT MILEAGE & EXPENSE REIMBURSEMENT

Additional Tools & Resources

What To Do If You Forget To Track Your Mileage

Manual Expense Reports: The Hidden Costs

Google Maps Mileage Tracking Explained

Massachusetts Mileage Guide

TAKE WITH YOU

Downloads

Company Mileage Log Template Download

Self-employed Mileage Log Template Download

California Mileage Compliance Guidebook Download

ROI White Paper

TripLog Mileage Policy Handbook

Illinois Mileage Compliance Guidebook Download

Sample Mileage Reimbursement Policy

Case Studies

Massachusetts Mileage Compliance Guidebook Download