- Products

Mileage

Expense

Time

Mileage

Expense

Time

- PartnersLearn more

Book a call with our experts

Book a call with our expertsDiscover how TripLog can drive time and cost savings for your company.

- SolutionsSolutions

TripLog is the market’s premier mileage and expense tracking solution. We cater to businesses of all sizes and industries.

Find out how much your company can save: - ResourcesTools

Learn about new features, tips & tricks, and how people have used TripLog to save thousands of dollars and man-hours.

Essential Reading:Resources - Pricing

- What’s new

Effortless Mileage Reimbursement for Public and Nonprofit Sectors

Whether you’re supervising caseworkers, organizing a food drive, or participating in other vital operations management, you need to stretch your budget while providing excellent service.

TripLog’s mileage tracking and reimbursement solutions are designed to save companies time and money.

Don’t forget: Ask about our non-profit discount!

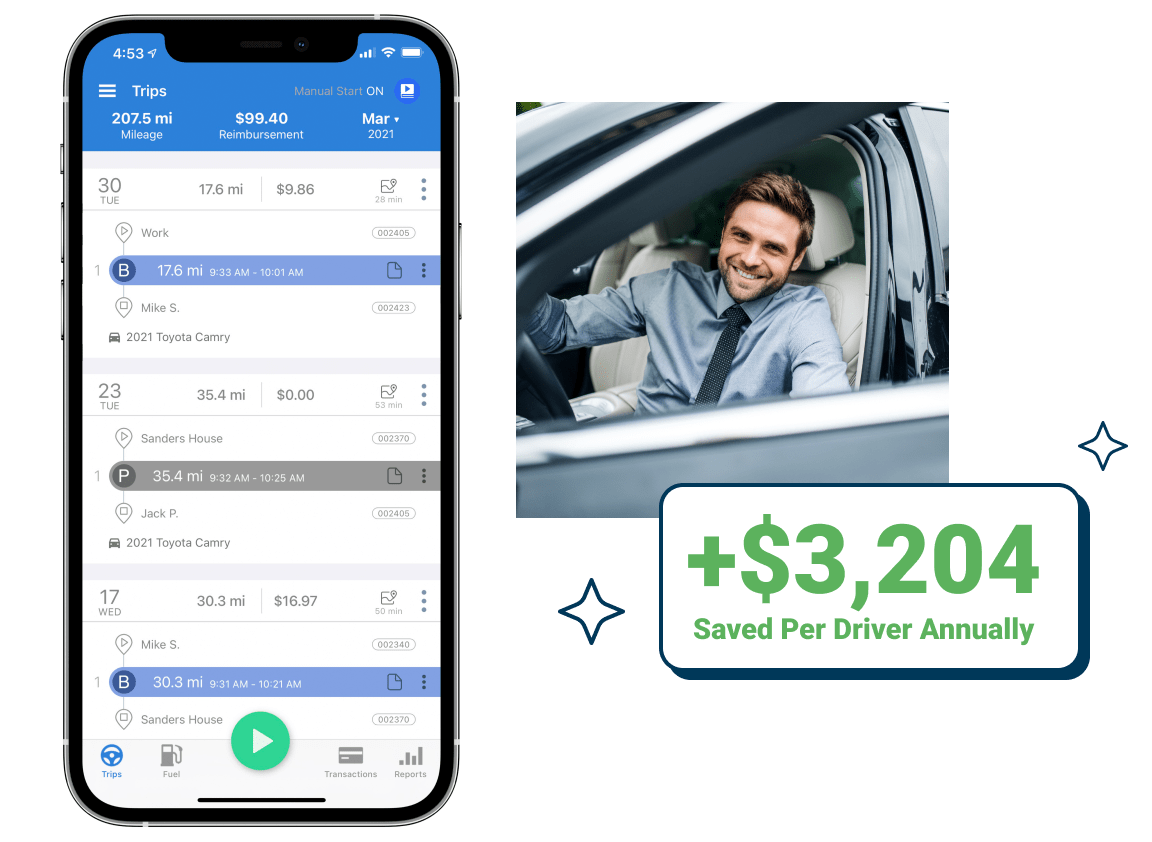

MILEAGE TRACKING YOU CAN TRUST

With TripLog, your drivers can focus on their work, not their mileage.

Automatic Tracking = Accurate Reports

TripLog starts tracking when your team starts driving, and stops when they stop. This means they will have an accurate record of their mileage, every single time.

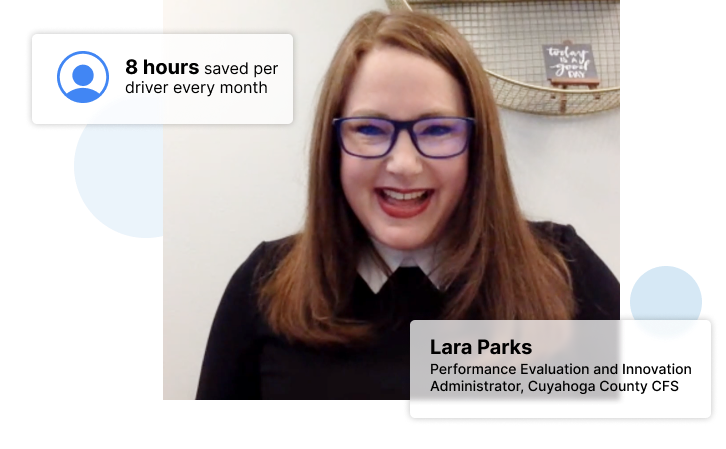

Drivers Save 8 Hours Per Month

TripLog makes it easy for employees to automatically record their business miles, freeing up their time to focus on what truly matters – serving their community.

TripLog also gives you insights into driver safety issues like speeding, phone calls, and hard braking. Your team will better understand what’s expected of them on the road.

TripLog connects with the tools you already use.

Seamlessly blend TripLog with your existing workflow. No other mileage reimbursement solution integrates with as many popular accounting, payroll, and CRM systems, making expense reporting a breeze.

MANAGE YOUR TEAM

Turn mileage reimbursement from a headache to a cost-saver.

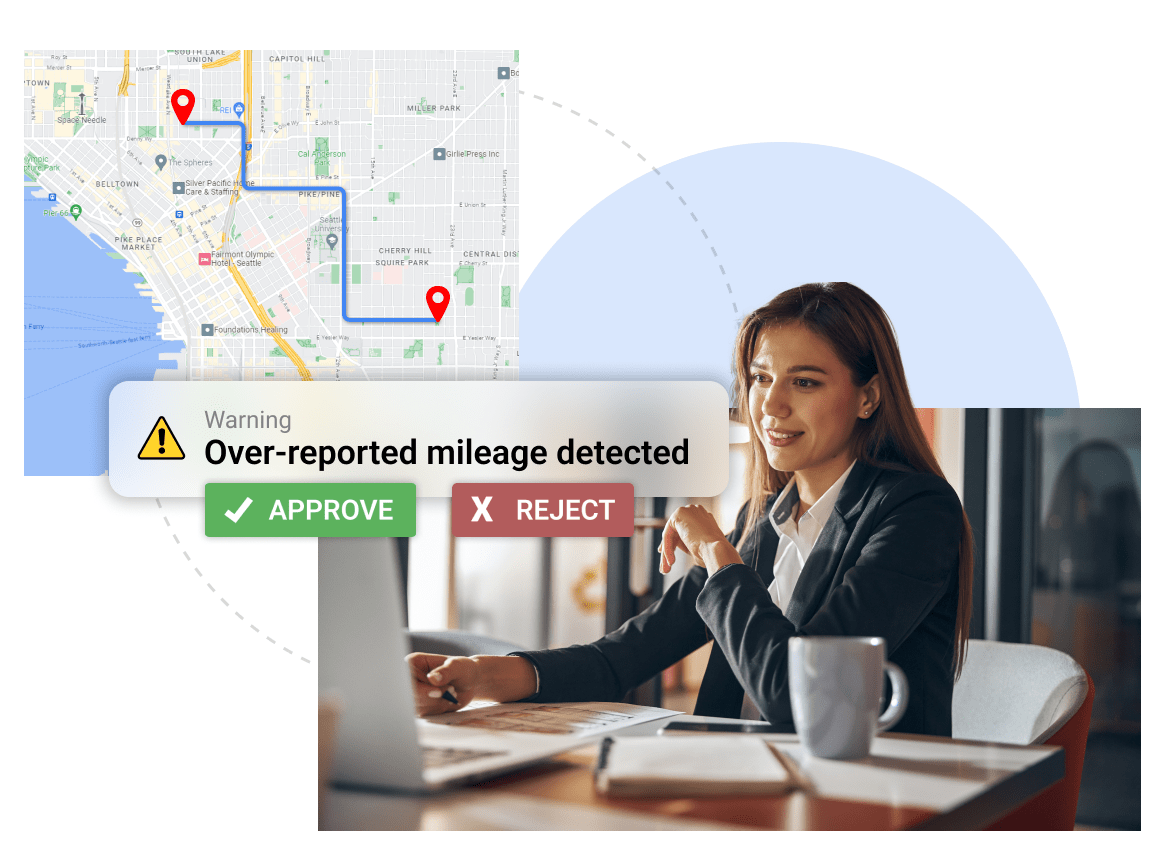

Simplified Approval Process

Say goodbye to the hassle of manual approval processes. With TripLog, you can easily review and approve mileage reports, all from a single easy-to-use dashboard.

Over-Reported Mileage Flagging

With powerful over-reported mileage flagging features, you can rest easy knowing your team’s reimbursements are accurate, every single time.

TripLog is as feature-rich as it is customizable. With powerful tools like location stay time, a shared company directory, custom tags & fields, and so much more, TripLog can do it all, with more features and customizability than any other mileage reimbursement solution.

MONEY MANAGEMENT

Expense Tracking Done Right

Nonprofit? Let Them Know.

Both the government and nonprofit organizations have certain expectations in regard to transparency. TripLog’s detailed expense reports allow you to show donors and taxpayers how their money is being spent.

OCR Gas Receipt Tracking

To make things easy, your team can simply snap a photo of their fuel receipts and our app will automatically fill in the data!

Here at TripLog, we understand that every penny counts. Adding another expense is something that nonprofits and government entities can’t do lightly. With that said, the savings that a powerful expense tracking solution can provide will quickly be apparent.

Out With The Old. In With The New.

Ditch Paper Time Tracking For A Modern Solution

Categorize Tasks & Jobs

Track your team’s schedules and see the time allotted for each task. Your team can submit their hours for your approval. Avoid time theft via methods such as buddy punching.

Submit & Approve Time Cards

Managers can review and approve time reports from TripLog’s intuitive dashboard. Track progress at a glance and discover inefficiencies.

Thousands of happy customers, one premier product.

At TripLog, the satisfaction of our customers is our only metric of success. With that in mind, we’re proud to boast about our impeccable customer satisfaction rates and the meaningful relationships we’ve built over the years.

We recently spoke with one such customer about her organization’s experience with TripLog and how our product not only streamlined their operations but also resulted in significant cost savings and time efficiency.

Welcome to modern mileage reimbursement.

Cost Savings: The true costs of manual mileage and expense tracking are staggering, but often unnoticed. With TripLog, companies can save an average of $3918 per employee each year.

Policy Making: With TripLog’s administrator dashboard, owners and managers can enforce policies for mileage and expenses.