- Products

Mileage

Expense

Time

Mileage

Expense

Time

- PartnersLearn more

Book a call with our experts

Book a call with our expertsDiscover how TripLog can drive time and cost savings for your company.

- SolutionsSolutions

TripLog is the market’s premier mileage and expense tracking solution. We cater to businesses of all sizes and industries.

Find out how much your company can save: - ResourcesTools

Learn about new features, tips & tricks, and how people have used TripLog to save thousands of dollars and man-hours.

Essential Reading:Resources - Pricing

- What’s new

Home Healthcare Mileage Tracking & Reimbursement

Home healthcare is an industry that demands diligence and consistency like no other. With TripLog’s powerful mileage and expense reimbursement solutions, you can help your business avoid audits and save time, money, and headaches.

Travel & Mileage

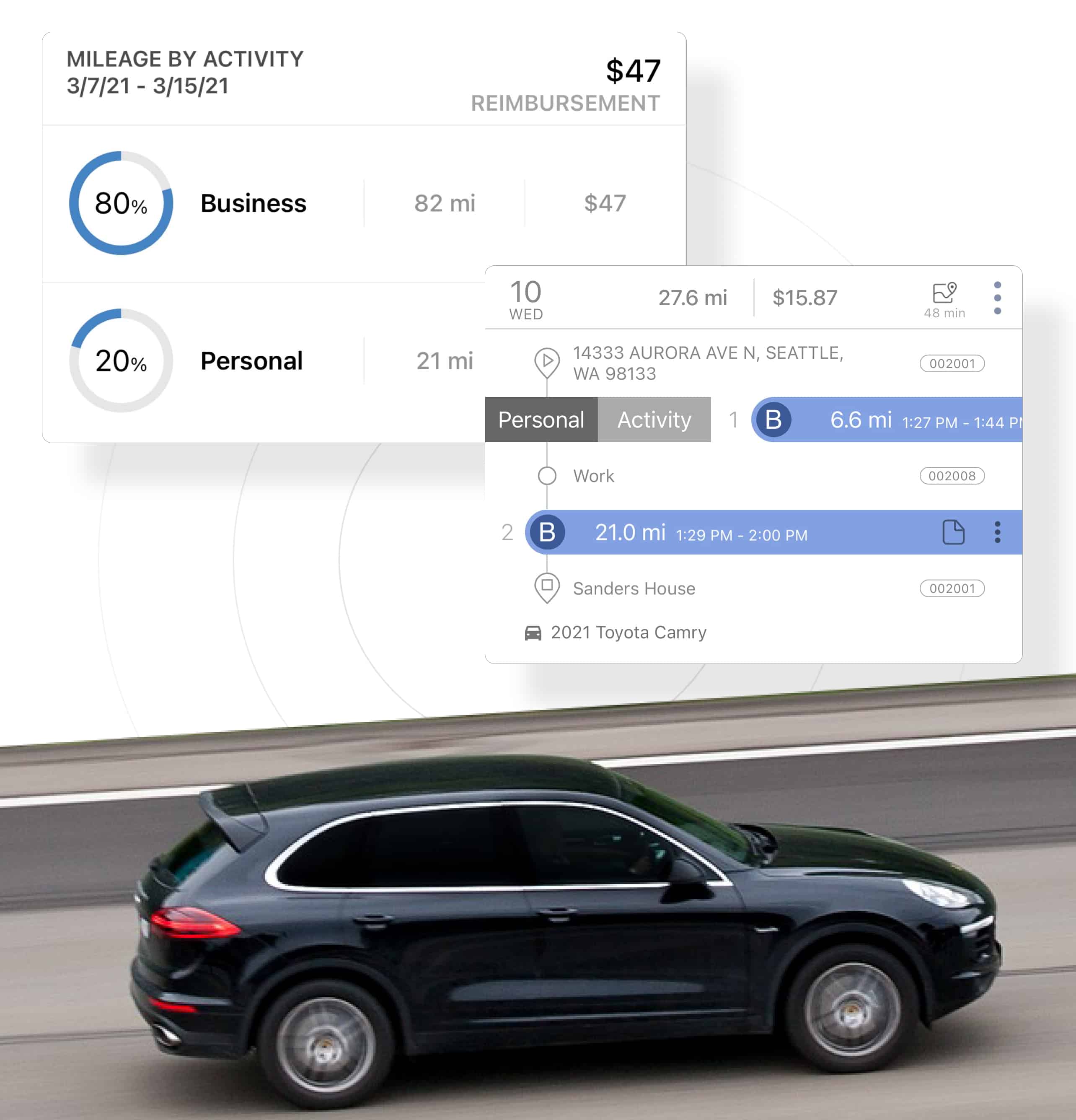

Ensure Your Providers' Mileage Is Logged Correctly

Automatic Mileage Tracking

By switching to a modern automatic mileage tracker app like TripLog, companies can save thousands per driver on inaccurate and time-consuming manual logs.

Accurate Reimbursements

With TripLog’s admin dashboard, your team can easily export their driving summaries for fast and error-free mileage reimbursements.

MONEY MANAGEMENT

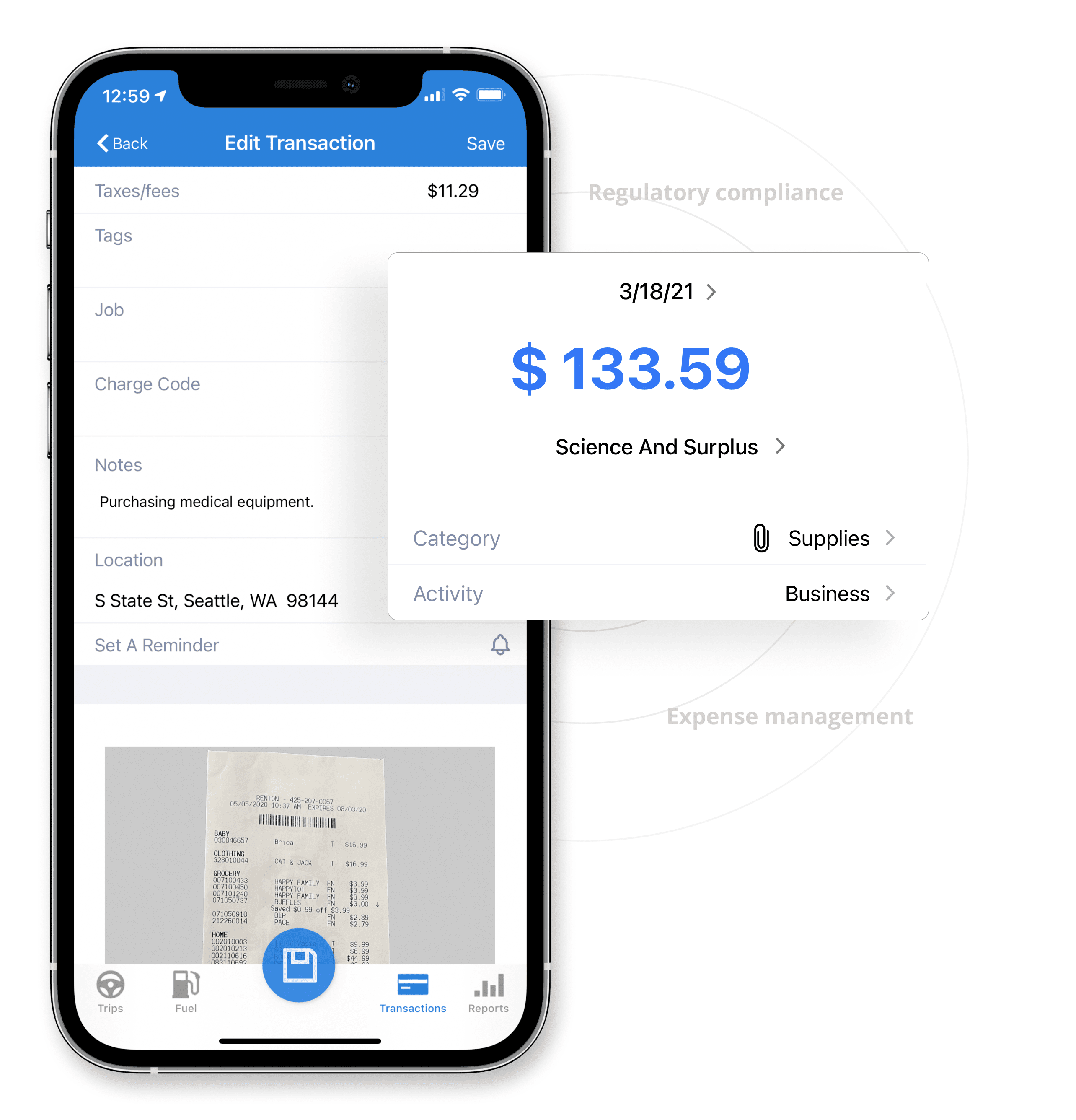

Manage Your Team's Expenses

Healthcare Expense Reporting

TripLog’s powerful expense management tools ensure that every dollar and cent is accounted for. Generate detailed expense reports to help you make sound decisions that will affect your business.

Gas Receipt Tracking

In addition to manual entry, TripLog also has OCR capabilities. Your team can simply snap a photo of their fuel receipts and our app will automatically fill in the data.

ON THE CLOCK

Time Tracking and Scheduling Made Simple

Categorize Tasks & Jobs

Track each provider’s schedule and see allotted time for every single task, project, or patient. Your team can categorize by project, client, or code, and they can submit their hours for your approval.

Submit & Approve Time Cards

Managers can review and approve time reports from TripLog’s intuitive dashboard. Track progress at a glance, see where your team has allocated time, and discover inefficiencies to help your business grow.

Carnegie Mellon states that healthcare is among the top 3 sectors where time theft occurs. Using a modern time tracking app like TripLog is the best way to prevent it.

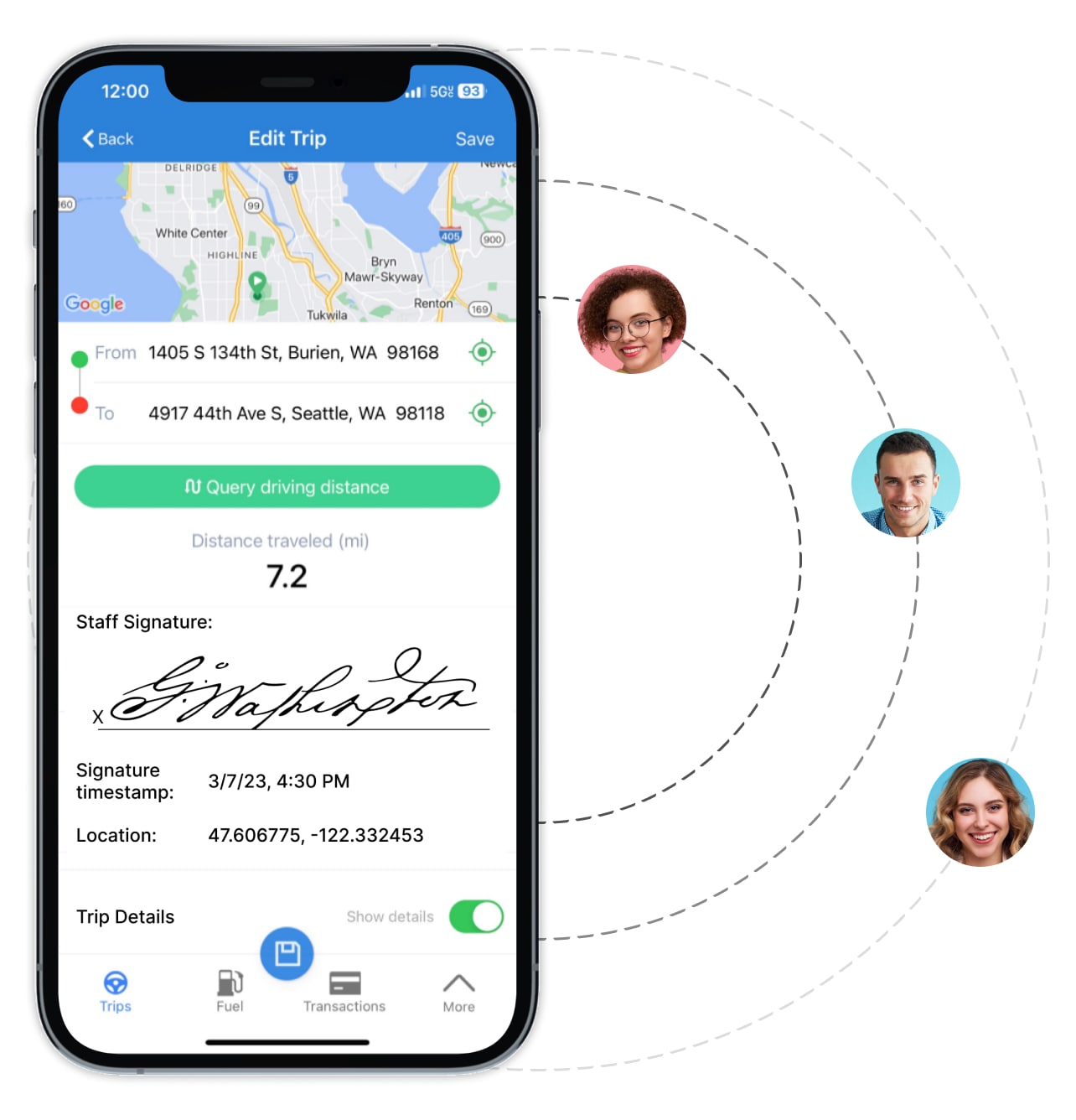

EXCLUSIVE FEATURES

Electronic Vehicle Verification

TripLog is the only mileage tracking and reimbursement solution to natively offer EVV. Your team are able to verify time in and time outs by location, add time- and location-stamped electronic staff signatures, and everything else you’ll need to stay CARES Act-compliant.

All The Features Your Business Will Need In One Place

Mileage & Expense Tracking For Healthcare Providers

Stay Compliant

You can rest assured knowing that all of our features are HIPAA compliant. In addition, TripLog’s reports are IRS, CRA, and HMRC compliant so you can avoid costly audits.

Privacy Matters

Data security and privacy are our highest priority. TripLog protects PHI (protected health information) and PII (personally identifiable information) via the industry’s best encryption technology and data management policies.

Review. Report. Rest Easy.

With TripLog, your team’s mileage is calculated with impeccable precision and their data is automatically added into detailed and intuitive expense reports.

An essential tool for businesses with traveling healthcare workers

Whether your team member is an RN, home healthcare aid, or a specialty caregiver traveling between facilities and patients’ homes, they will need to accurately track their mileage, expenses, and hours for proper mileage reimbursement. TripLog is the market’s best and most cost-effective tool to do so.

The Numbers: According to the United States Census Bureau, healthcare is the single biggest industry in the US, with over 20 million workers in 2018. This accounts for over 10% of the total workforce in the country.

Home Healthcare: Of that 20 million, nearly 1/20 are home healthcare providers. If your employees travel to provide healthcare services, it’s paramount that they accurately track their mileage, expenses, and time.

Integrations & Customers: TripLog is trusted by Fortune 100 companies such as Humana, as well as local healthcare groups such as MHMR of Tarrant County, TX. In addition, TripLog integrates with industry-leading tools like QuickBooks, ADP, and more.