- Products

Mileage

Expense

Time

Mileage

Expense

Time

- PartnersLearn more

Book a call with our experts

Book a call with our expertsDiscover how TripLog can drive time and cost savings for your company.

- SolutionsSolutions

TripLog is the market’s premier mileage and expense tracking solution. We cater to businesses of all sizes and industries.

Find out how much your company can save: - ResourcesTools

Learn about new features, tips & tricks, and how people have used TripLog to save thousands of dollars and man-hours.

Essential Reading:Resources - Pricing

- What’s new

Mileage Tracking For Sales Representatives

When generating revenue is your primary priority, any time you’re not selling can feel like time wasted. It’s common to back-burner administrative tasks. With TripLog, company mileage and expense tracking are simpler and more convenient than ever before.

Travel & Mileage

Salespeople Do A Lot of Travel. Tracking Their Mileage Is Essential.

Route Planning

TripLog’s mileage tracker app enables you and your team to plan the most efficient driving routes throughout the workday. You can upload address books for ease of destination selection, separate business and personal trips, and categorize important trip details.

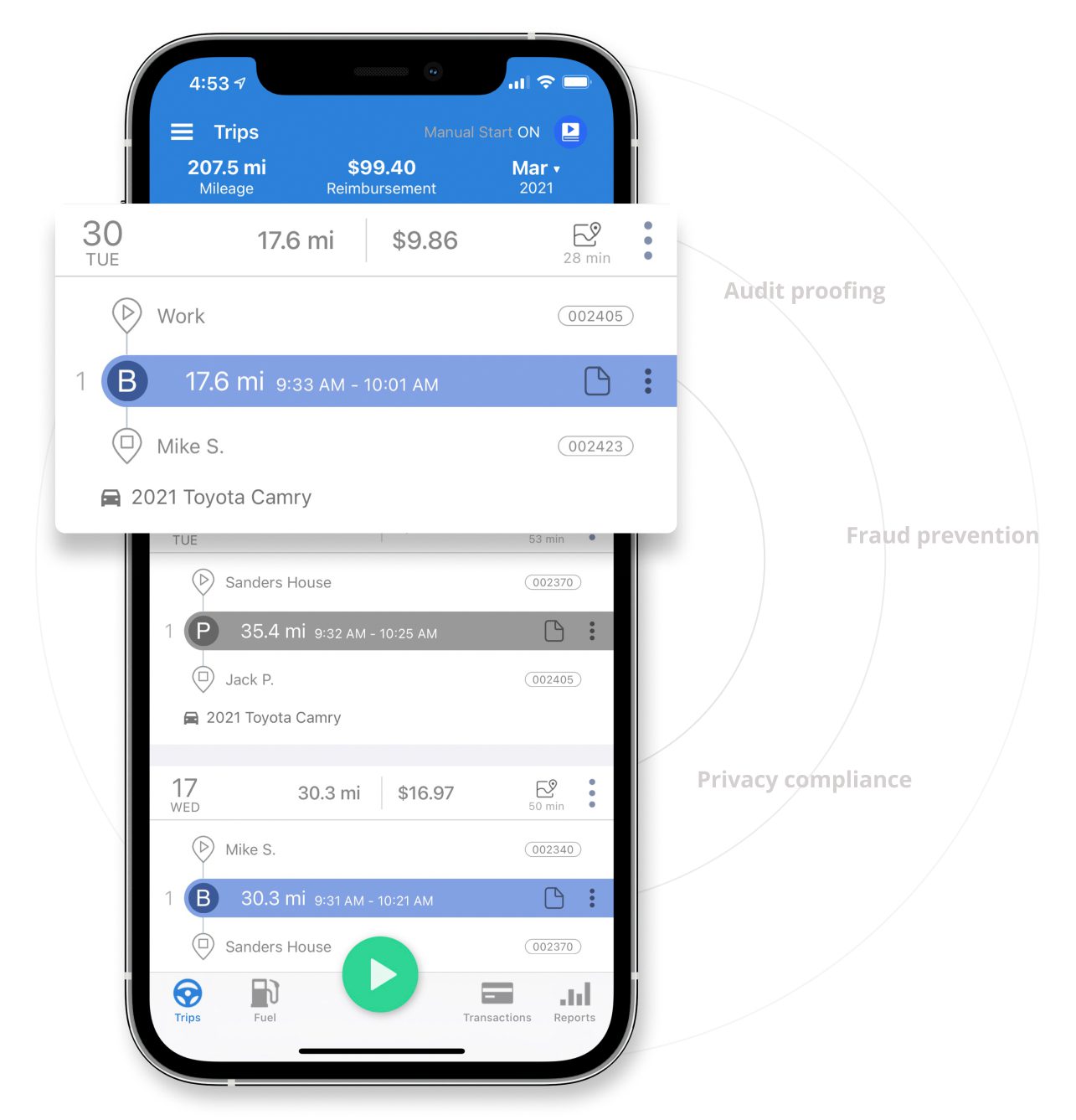

Automatically Track Mileage

With six different auto start options, as well as other customization options, you can rest assured that your team’s mileage is always tracked accurately.

MONEY MANAGEMENT

Expense Tracking Made Simple

Powerful Expense Management

TripLog can help your company reduce labor costs by seamlessly integrating with popular accounting, payroll, and travel management software solutions, so you never have to waste time doing redundant data entry.

Gas Receipt Tracking

With TripLog’s OCR capabilities, your team can simply snap a photo of their fuel receipts and our app will automatically fill in the data, giving you more control over your company’s expenses.

Out With The Old. In With The New.

Are Team Members Meeting Multiple Clients? Help Them Stay Organized With TripLog Time.

Clock In. Clock Out. Rest Easy.

TripLog’s time and attendance feature lets your sales team clock in-and-out using an intuitive calendar-based interface. In addition, they can track their day by task or client.

Web Admin Dashboard

With TripLog’s intuitive dashboard, managers can get in-depth summaries and detailed reports, designed to help you make sound decisions regarding your business and team.

TripLog Transform the Way Your Business Tracks Its Mileage and Expenses

Tax Compliance: TripLog is designed with your taxes in mind. Our reports are taken straight from the tax forms to make your expense tracking easy so your accountant will be sure to love them.

Data-Driven: With access to easy access to your data, companies are able to make sound decisions regarding future budgets. In addition, TripLog integrates with many industry-leading tools like QuickBooks, ADP, and more.

Policy Making: With TripLog’s advanced and detailed administrator dashboard, owners and managers can enforce company policies for mileage and expenses.