Every year, the IRS releases its standard mileage rate, a rate per mile that individuals and businesses can use to calculate tax deductions or reimbursements for the business use of their personal vehicles.

Related: 2025 IRS Standard Mileage Rate Explained | What Is the 2025 Mileage Rate?

This rate is designed to serve as an easy way to account for vehicle expenses like gas, maintenance, insurance, and depreciation. Instead of painstakingly tracking each and every cost individually, the IRS conducts an annual study to determine the various costs associated with owning and operating a car.

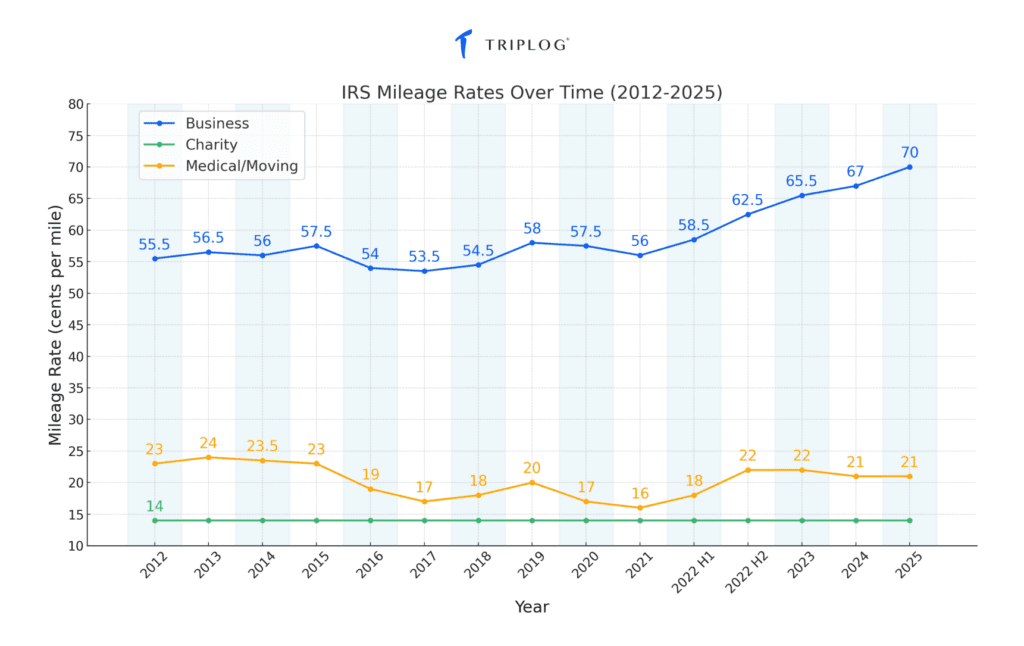

Usually, the mileage rate increases once per year, though it has occasionally decreased. In addition, rare mid-year increases have occurred. Whether you’re a business owner, self-employed individual, or you manage a mobile workforce, understanding the trends with the rate changes can help your bottom line.

Recent IRS Mileage Rate History (2015 – 2025)

Notable Changes to the Mileage Rate in the Last 10 Years

2015 – 2017 was a period that saw the mileage rate have a consistent decrease, going from 57.5 cents per mile in 2015 to 54 in 2016 to 53.5 in 2017.

2018 saw the mileage rate increase by a cent to 54.5.

2019 saw one of the biggest jumps in recent history, going up 3.5 cents to 58 cents per mile.

2020 and 2021 was another period where the mileage rate decreased, dropping to 57.5 and then 56 cents per mile, respectively. The COVID-19 pandemic resulted in reduced travel, likely contributing to the rates being lowered.

2022 brought an increase in the rate, jumping 2.5 cents to 58.5 cents per mile. However, more notable in that year was the extremely rare mid-year increase, jumping another 4 cents to 62.5 cents per mile in July of that year.

Inflation was at its highest rate in decades, which, coupled with increased fuel costs, resulted in the rare decision to issue a mid-year mileage rate increase.

Some of these issues persisted into 2023, where the standard mileage rate was increased to 65.5 cents per mile. Outside of 2008’s mid-year increase, this year-over-year increase of 7 cents per mile is the largest jump since the IRS began issuing standard mileage rate recommendations.

Things had stabilized by 2024, which saw an increase of just 1.5 cents per mile, bringing the rate to 67 cents per mile, the smallest increase since 2017-2018.

Finally, in 2025, the rate increased another 3 cents per mile to 70, likely as a result of vehicle maintenance and fuel costs continuing to increase.

Full IRS Mileage Rate Changes (1997-2025)

Here are the mileage rates in cents per mile since 1997:

| Period | Business | Charity | Medical & moving |

| 2025 | 70 | 14 | 21 |

| 2024 | 67 | 14 | 21 |

| 2023 | 65.5 | 14 | 22 |

| 2022 (Jul – Dec) | 62.5 | 14 | 22 |

| 2022 (Jan – Jun) | 58.5 | 14 | 18 |

| 2021 | 56 | 14 | 16 |

| 2020 | 57.5 | 14 | 17 |

| 2019 | 58 | 14 | 20 |

| 2018 | 54.5 | 14 | 18 |

| 2017 | 53.5 | 14 | 17 |

| 2016 | 54 | 14 | 19 |

| 2015 | 57.5 | 14 | 23 |

| 2014 | 56 | 14 | 23.5 |

| 2013 | 56.5 | 14 | 24 |

| 2012 | 55.5 | 14 | 23 |

| 2011 (Jul – Dec) | 55.5 | 14 | 23.5 |

| 20011 (Jan – Jun) | 51 | 14 | 19 |

| 2010 | 50 | 14 | 16.5 |

| 2009 | 55 | 14 | 24 |

| 2008 (Jul – Dec) | 58.5 | 14 | 27 |

| 2008 (Jan – Jun) | 50.5 | 14 | 19 |

| 2007 | 48.5 | 14 | 20 |

| 2006 | 44.5 | 14 | 18 |

| 2005 | 40.5 | 14 | 15 |

| 2004 | 37.5 | 14 | 14 |

| 2003 | 36 | 14 | 12 |

| 2002 | 36.5 | 14 | 13 |

| 2001 | 34.5 | 14 | 12 |

| 2000 | 32.5 | 14 | 10 |

| 1999 | 31 | 14 | 10 |

| 1998 | 32.5 | 14 | 10 |

| 1997 | 31.5 | 12 | 10 |

Why the IRS Adjusts the Standard Mileage Rate

Each year, the IRS reviews and estimates the fixed and variable costs of owning and operating a vehicle. Depending on how much these costs increase or decrease, the IRS will increase or decrease the rate accordingly.

Fixed Costs Considered in Selecting the Mileage Rate

- Vehicle depreciation

- Insurance premiums

- Registration and licensing fees

- Vehicle loan interest or lease payments

Variable Costs Considered in Selecting the Mileage Rate

- Fuel prices

- Maintenance and repairs

- Tire replacements

- Oil changes and routine service

The IRS usually announces the rate change each December for the upcoming year. However, there have been rare cases where significant events may trigger mid-year adjustments.

Related: How Is the Standard IRS Mileage Rate Determined? | IRS Mileage Rate Breakdown Explained

Here are the instances where the IRS has adjusted the mileage rate mid-year and why they may have occurred:

- 2022: High inflation and fuel costs

- 2011: Global tensions affecting oil prices

- 2008: Financial crisis impact

- 2005: Hurricane Katrina’s effect on fuel supplies

Who Can Use the IRS Mileage Rate (And How)

Depending on your situation, the IRS standard mileage rate may affect you differently.

Self-Employed Individuals and Business Owners

If you’re a sole proprietor using your personal vehicle for work, you can deduct your miles that you drove for work using the IRS mileage rate. For example, if you drove 100 miles, you would be able to deduct $70 off of your taxes using the 2025 mileage rate.

Related: How to Calculate Your Mileage for Taxes or Reimbursement in 2025

You can also track your mileage with the actual expenses method, though most use the mileage rate for simplicity. In order to take advantage of the IRS standard mileage rate, you are required to keep detailed mileage logs.

One of the easiest ways for people who use their personal vehicles for work to track their mileage for tax deductions is to use automatic mileage tracker apps like TripLog. These apps start tracking your mileage when you start driving, and stop when you stop, making keeping detailed reports a breeze.

Employers and Their Employees

In most states, companies are not required to reimburse their employees’ mileage (unless their vehicle usage costs would put them below the minimum wage). Still, most choose to offer reimbursement as a perk.

Related: What Do Most Businesses Pay for Mileage Reimbursement? | How Much To Reimburse Your Drivers’ Mileage

Companies can set their own mileage rates if they choose to, though many simply choose to use the IRS standard mileage rate for simplicity’s sake.

Mileage Rate History FAQ

Q: What is the current IRS mileage rate for 2025?

A: The standard business mileage rate for 2025 is 70 cents per mile.

Q: Why did the mileage rate increase in 2025?

A: The increase likely reflects rising vehicle operating costs related to maintenance, insurance rates, and vehicle depreciation trends.

Q: What records do I need to keep for mileage deductions?

A: The IRS requires:

- Date of each trip

- Business purpose

- Starting and ending locations

- Business miles

- Total miles driven

Q: Can I switch between the actual expenses method and the standard mileage rate?

A: If you use the standard mileage rate in the first year, you can switch methods in later years. However, if you choose to use the actual expenses method, you must continue using that method for the duration of your ownership of the vehicle.

Related: Standard Mileage Deduction vs. Actual Expenses Method Explained

IRS Mileage Rate History: Conclusion

It can be helpful for both businesses and individuals to know and understand the trends related to the IRS standard business mileage rate. For those needing to track their or their team’s mileage, fast and accurate methods are a must.

Rather than having to deal with inaccurate manual logs and spreadsheets, using an automatic mileage tracker app like TripLog can make the process easy and headache-free.

TripLog automatically applies current mileage IRS rates, captures all required information, and generates IRS-compliant reports. Plus, the TripLog mobile app offers unlimited automatic mileage tracking for free!

You can download TripLog on iOS or Android and start tracking your mileage automatically for free today. Thanks for reading!