The 2025 IRS standard business mileage rate is designed to cover the cost of workers using their personal vehicles to conduct business. Whether you’re an employee using your personal vehicle to do work on behalf of a company you work for or you’re self-employed, the IRS provides a rate for business reimbursement and tax deductions.

It’s worth noting that employers are not required to use the rate published by the IRS. However, if the employer offers mileage reimbursement for their employee that goes above the rate, the employee must pay income tax on that additional amount.

There are different rules for individuals who use their personal vehicles for business compared to those who use them for medical or charitable purposes. Please view our other pages in this guide for specific rules relating to mileage tracking for employees, employers, or self-employed workers.

What is the 2025 IRS Mileage Rate?

Beginning January 1, 2025, the standard mileage rates for vehicles, including vans, pickups, and panel trucks, are as follows:

- $0.70 per mile for business

- $0.21 per mile for medical purposes

- $0.21 per mile for moving (used only for Armed Forces individuals on active duty)

- $0.14 per mile for service of charitable organizations

If you want more detailed information about the standard mileage rates, you can find it on the IRS website.

Related: IRS Mileage Log Requirements for Tax Deductions & Reimbursements

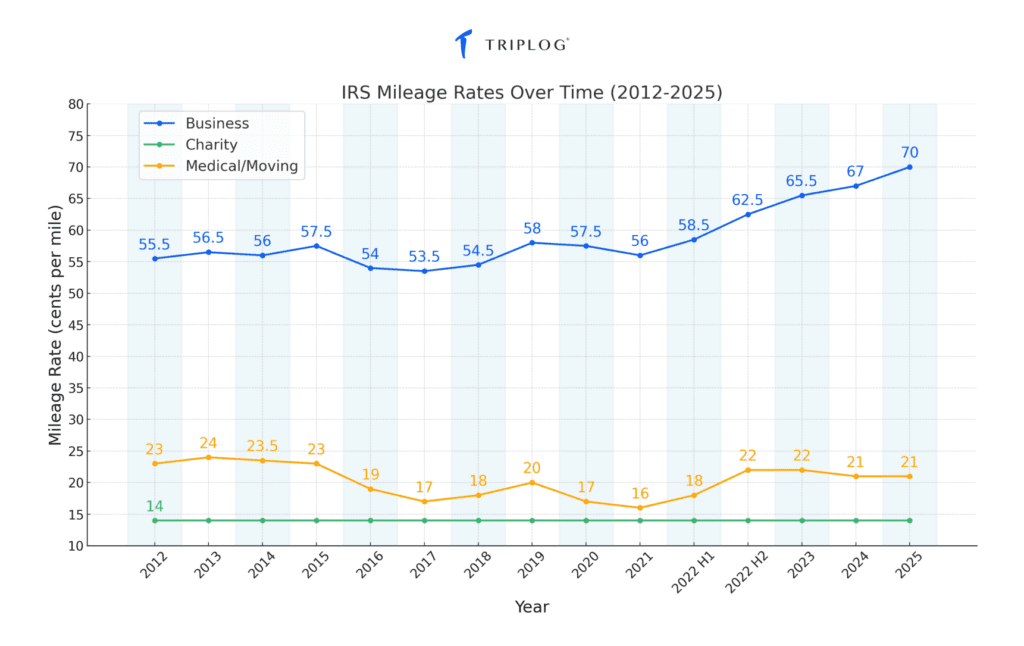

Previous Years’ Standard IRS Mileage Rates

The IRS standard mileage rates typically change each year, usually going up or down by a cent or two. Here are the mileage rates in cents-per-mile since 1997:

| Period | Business | Charity | Medical & moving |

| 2025 | 70 | 14 | 21 |

| 2024 | 67 | 14 | 21 |

| 2023 | 65.5 | 14 | 22 |

| 2022 (Jul – Dec) | 62.5 | 14 | 22 |

| 2022 (Jan – Jun) | 58.5 | 14 | 18 |

| 2021 | 56 | 14 | 16 |

| 2020 | 57.5 | 14 | 17 |

| 2019 | 58 | 14 | 20 |

| 2018 | 54.5 | 14 | 18 |

| 2017 | 53.5 | 14 | 17 |

| 2016 | 54 | 14 | 19 |

| 2015 | 57.5 | 14 | 23 |

| 2014 | 56 | 14 | 23.5 |

| 2013 | 56.5 | 14 | 24 |

| 2012 | 55.5 | 14 | 23 |

| Jul 1 – Dec 31, 2011 | 55.5 | 14 | 23.5 |

| Jan 1 – Jun 30, 2011 | 51 | 14 | 19 |

| 2010 | 50 | 14 | 16.5 |

| 2009 | 55 | 14 | 24 |

| Jul 1 – Dec 31, 2008 | 58.5 | 14 | 27 |

| Jan 1 – Jun 30, 2008 | 50.5 | 14 | 19 |

| 2007 | 48.5 | 14 | 20 |

| 2006 | 44.5 | 14 | 18 |

| 2005 | 40.5 | 14 | 15 |

| 2004 | 37.5 | 14 | 14 |

| 2003 | 36 | 14 | 12 |

| 2002 | 36.5 | 14 | 13 |

| 2001 | 34.5 | 14 | 12 |

| 2000 | 32.5 | 14 | 10 |

| 1999 | 31 | 14 | 10 |

| 1998 | 32.5 | 14 | 10 |

| 1997 | 31.5 | 12 | 10 |

What Does the IRS Standard Mileage Rate Refer To?

The IRS standard mileage rate is a recommended reimbursement rate for companies for their employees who use their personal vehicles to conduct business on behalf of their employer. For example, if a business chooses to use 2025’s mileage rate, they will reimburse their employee 70 ($0.70) cents per mile driven in their personal vehicle for business use.

This figure changes yearly and is based on the fixed and variable costs of owning and operating a motor vehicle. Things like gas, oil changes, vehicle depreciation, and other factors go into the IRS determining the number.

Related: IRS Mileage Rate Explained | How Is the Standard Mileage Rate Determined?

It is important to note that this is an optional rate for companies to offer to their employees. There isn’t a federal requirement or mandate to do so, although some states have their own requirements. Generally, companies that offer mileage reimbursement plans tend to hire and retain higher-quality candidates.

How To Use the 2025 IRS Mileage Rate

Proper mileage tracking is an often tedious and time-consuming process for employers, employees, contractors, freelancers, and business owners of all types. Using a company mileage tracker like TripLog makes calculating your mileage easier and faster.

You can download TripLog’s mileage tracker app for free on iOS or Android, or schedule a complimentary web demo today.