- Products

Mileage

Expense

Time

Mileage

Expense

Time

- PartnersLearn more

Book a call with our experts

Book a call with our expertsDiscover how TripLog can drive time and cost savings for your company.

- SolutionsSolutions

TripLog is the market’s premier mileage and expense tracking solution. We cater to businesses of all sizes and industries.

Find out how much your company can save: - ResourcesTools

Learn about new features, tips & tricks, and how people have used TripLog to save thousands of dollars and man-hours.

Essential Reading:Resources - Pricing

- What’s new

Company mileage reimbursement simplified.

TripLog customers see:

Proud ADP Marketplace Partner

The TripLog Difference

See why TripLog is the market’s #1 company mileage tracking & reimbursement product when compared to other leading competitors.

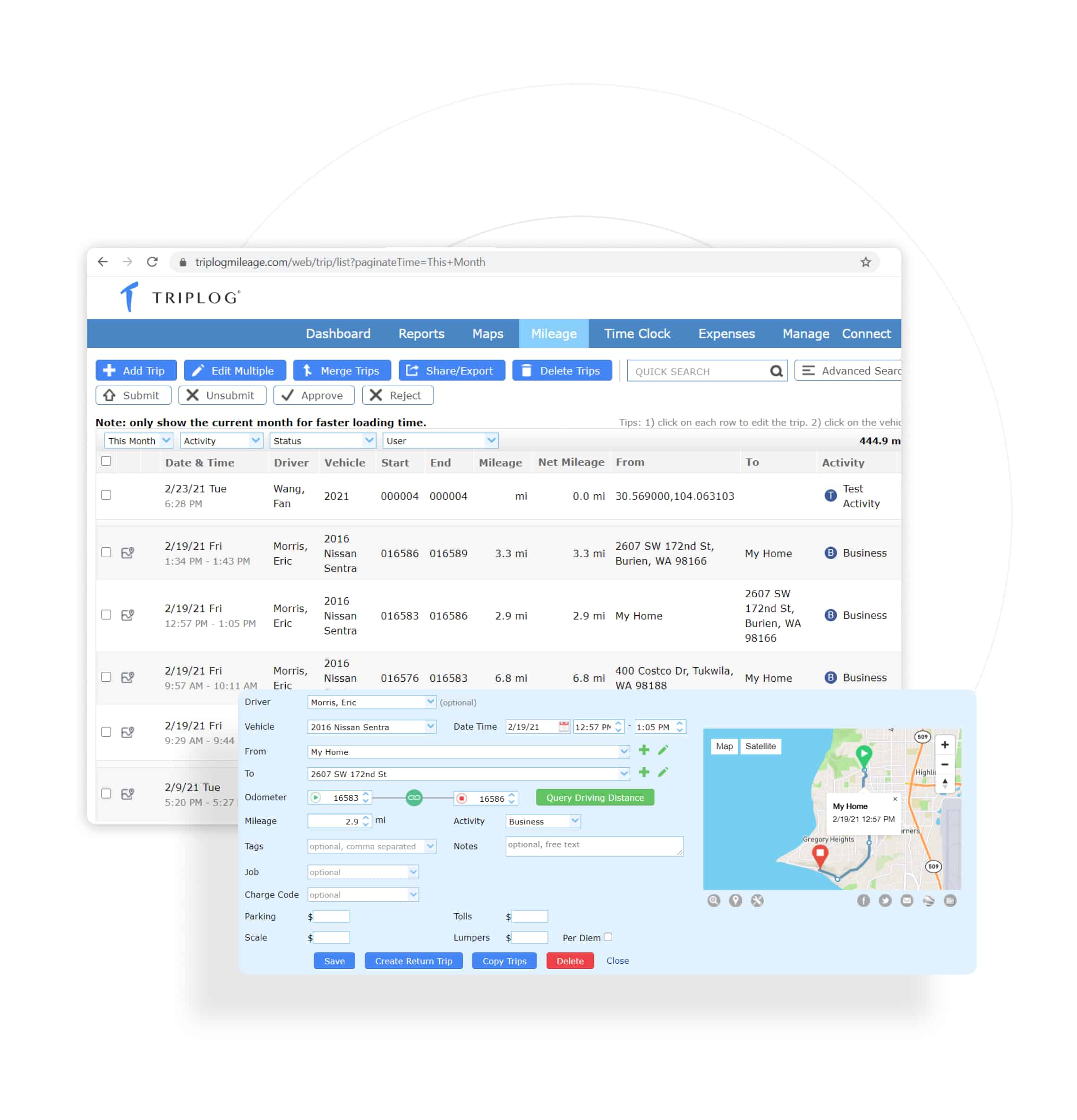

MODERN MILEAGE TRACKING

The #1 Company Mileage Tracker

The TripLog app gives your team a sleek, modern, GPS-based solution for tracking their mileage. With route planning features, a shared company address book, and easy trip classification, there’s simply no better way to track your mileage and expenses.

As TripLog automatically compares trips with Google Maps, your company can say goodbye to incorrect mileage for good.

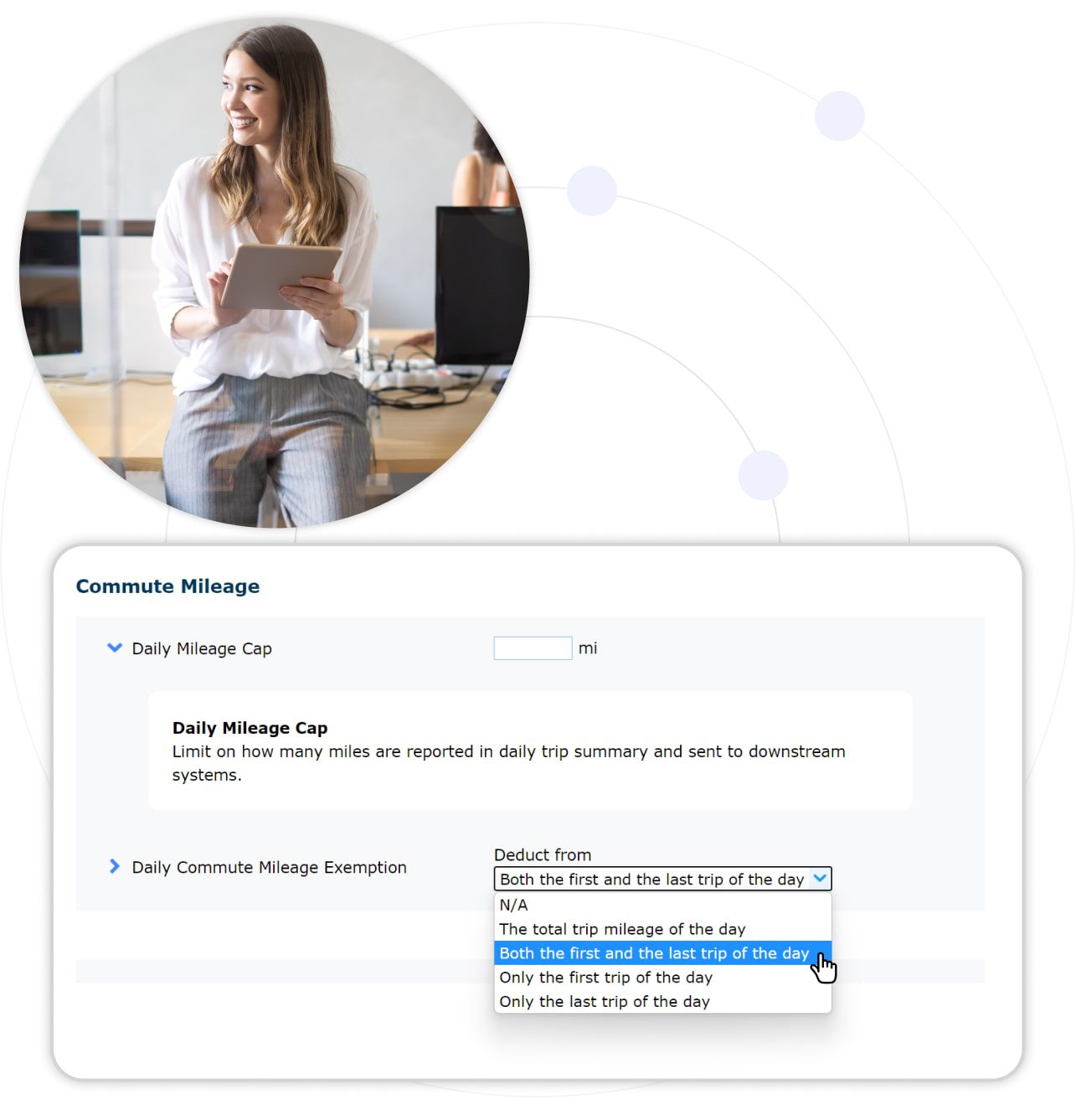

CREATE CUSTOM POLICIES

Automate Your Expense Management

TripLog has many features that can allow your company to automate many aspects of its expense management.

You can also set custom mileage and expense policies, such as commute exemptions, frequent trip rules, and shortest distance calculations.

TripLog's Unique Company Mileage Features

- Commute mileage exemption

- Approval management hierarchy

- Overreported mileage flagging

- Native gas, toll, & expense tracking

- Policy enforcement

- Shortest route rules

- Custom tag fields

POWERFUL REPORTING

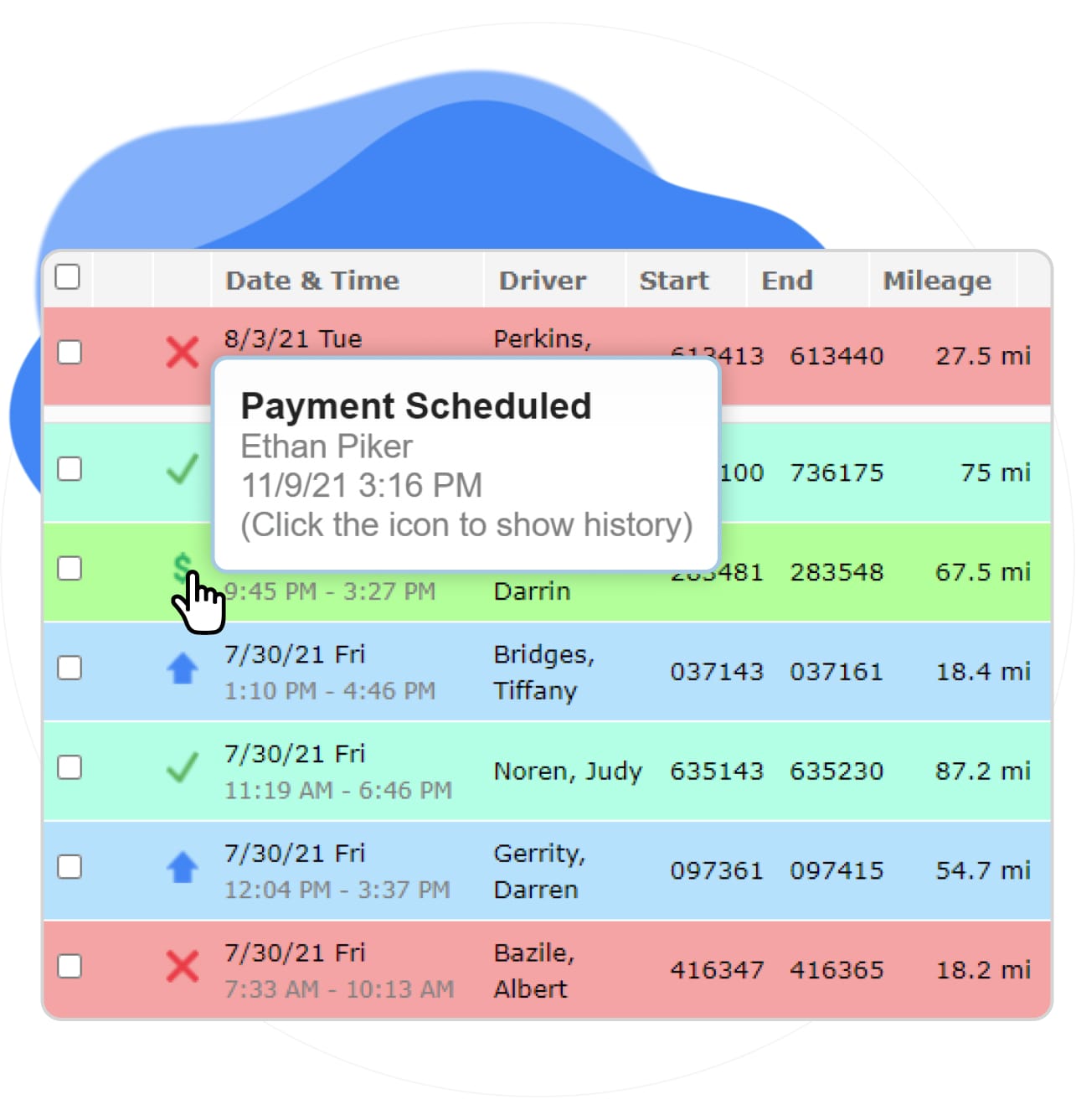

Complete Visibility and Reporting Insight

Paper logs are wasting a lot of time for your company each day. With TripLog’s centralized web dashboard, companies get real visibility and decision-making power. TripLog is designed from the ground up to speed up your company’s reimbursement process.

SAVE TIME

Increase Oversight & Accountability

Unlike other mileage and expense tracking solutions, TripLog’s centralized web dashboard provides you with the ability to hold your employees accountable. If you have ever had questions or concerns over spending, TripLog will prove to be an invaluable tool.

- TripLog offers real-time fleet tracking, allowing you to manage thousands of drivers easily.

- See routes and unsafe driving behaviors. Review each trip to spot any potential issues.

- View accurate GPS-based visit times and see your team’s daily routes.

- Businesses can create custom tags and fields, allowing admins to further refine their reporting process.

IRS COMPLIANCE

Fixed and Variable Rates (FAVR)

Simple cents-per-mile reimbursement is just one of the mileage programs we offer at TripLog. We specialize in all IRS-compliant mileage programs, including Car Allowance, Smart Mileage Rate, Fuel Cards, and Fixed and Variable Rates (FAVR). Contact us for a complimentary money-saving analysis. We would love to develop a tailored solution to fit your organization.