- Products

Mileage

Expense

Time

Mileage

Expense

Time

- PartnersLearn more

Book a call with our experts

Book a call with our expertsDiscover how TripLog can drive time and cost savings for your company.

- SolutionsSolutions

TripLog is the market’s premier mileage and expense tracking solution. We cater to businesses of all sizes and industries.

Find out how much your company can save: - ResourcesTools

Learn about new features, tips & tricks, and how people have used TripLog to save thousands of dollars and man-hours.

Essential Reading:Resources - Pricing

- What’s new

What is TripLog?

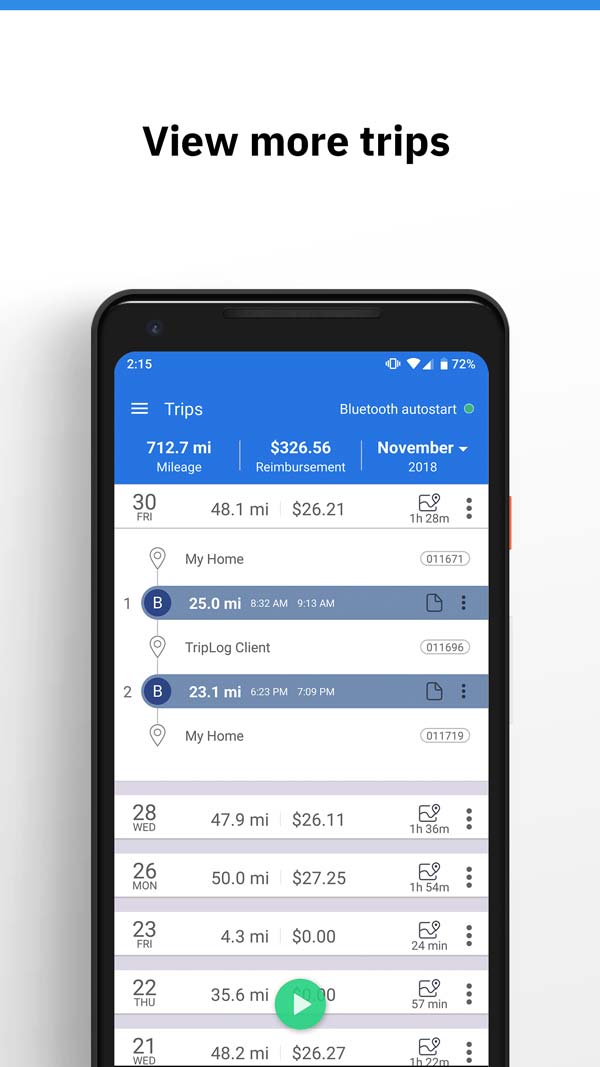

TripLog is the #1 mileage tracker app for small businesses. Some features include:

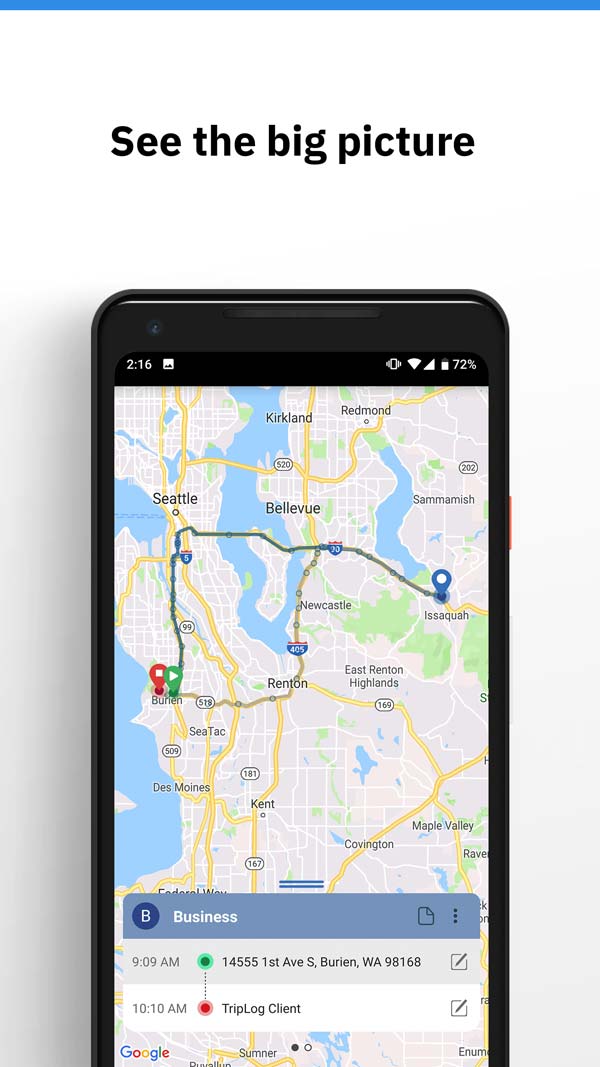

Automatic Mileage Tracking: Using the GPS on your mobile device, TripLog can automatically track mileage driven for your business. Whether for tax deductions, employee reimbursements, or invoicing your clients, TripLog has you covered with its advanced mileage tracking and detailed, tax-compliant reporting.

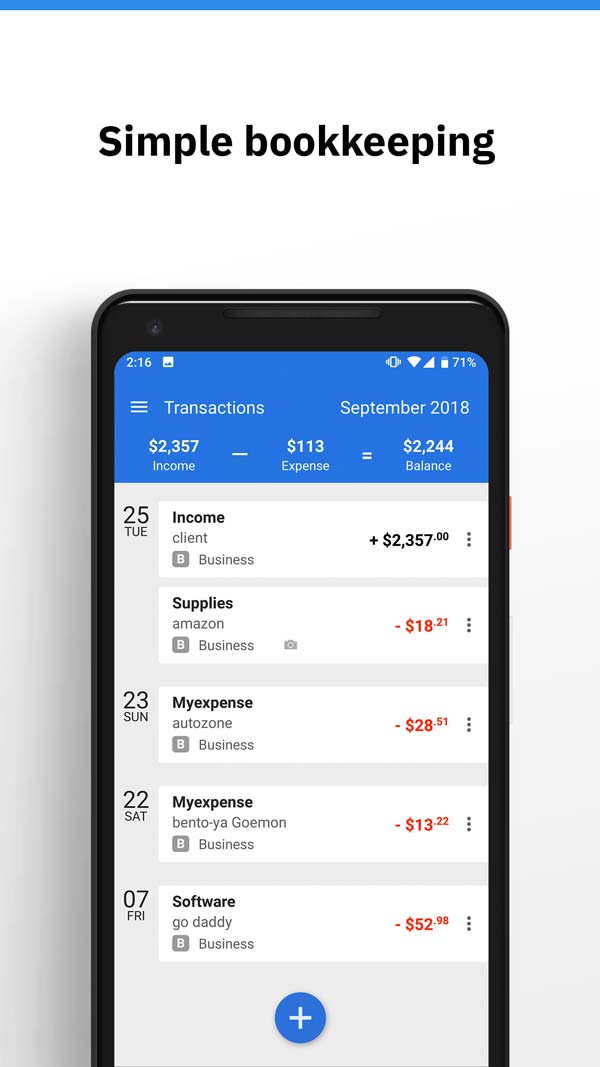

Expense Tracking: Keep an organized record of your business transactions using TripLog’s expense tracking features. With its ability to generate detailed expense reports and even attach images of receipts to each transaction entry, TripLog makes recording your business expenses a breeze.

Works for Canada, UK & Australia: TripLog works for Canadian, UK, and Australian customers, where kilometers, tiered tax rates, and fiscal years starting in April or July are applied in those countries.

TripLog for Accountants: Managing your client’s mileage has never been simpler! Generate tax-compliant mileage and business expense reports for your clients with one click. In addition, if you have two or more clients using TripLog, you can use the app’s tracking features for your own business mileage for free.

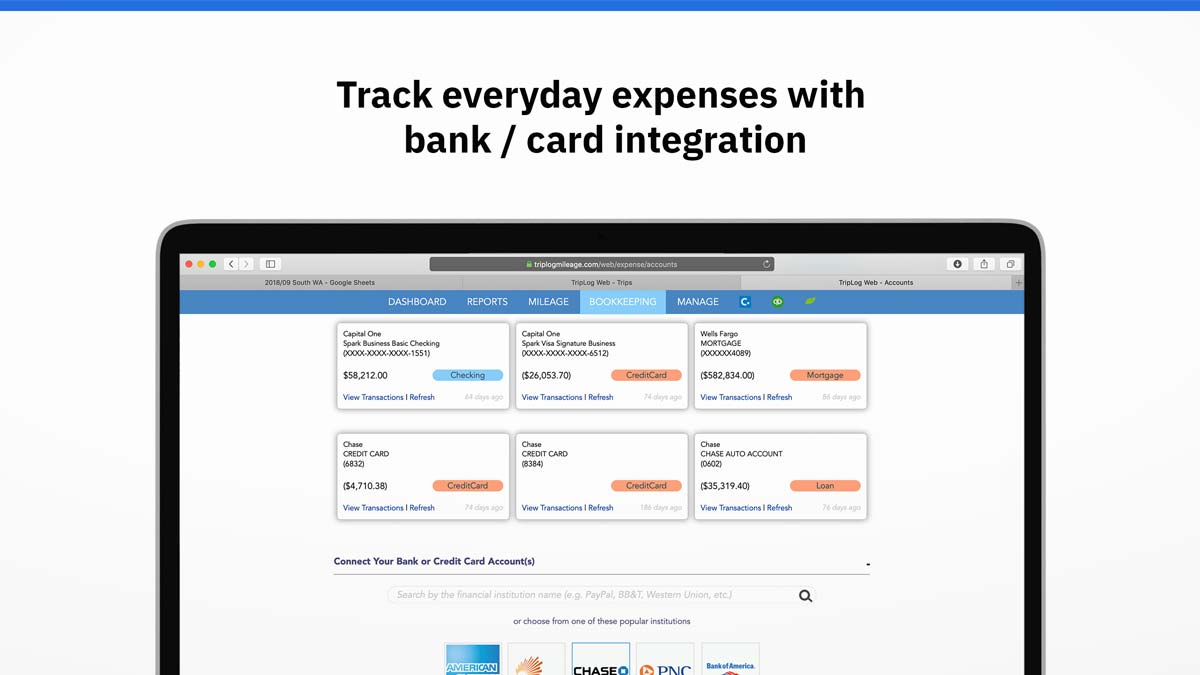

Bank and Credit Card Integration: Automatically track your business expenses straight from your bank or credit card account using TripLog’s bank and credit card integration. Customize bank rules to automatically classify transactions directly from your bank or credit card.

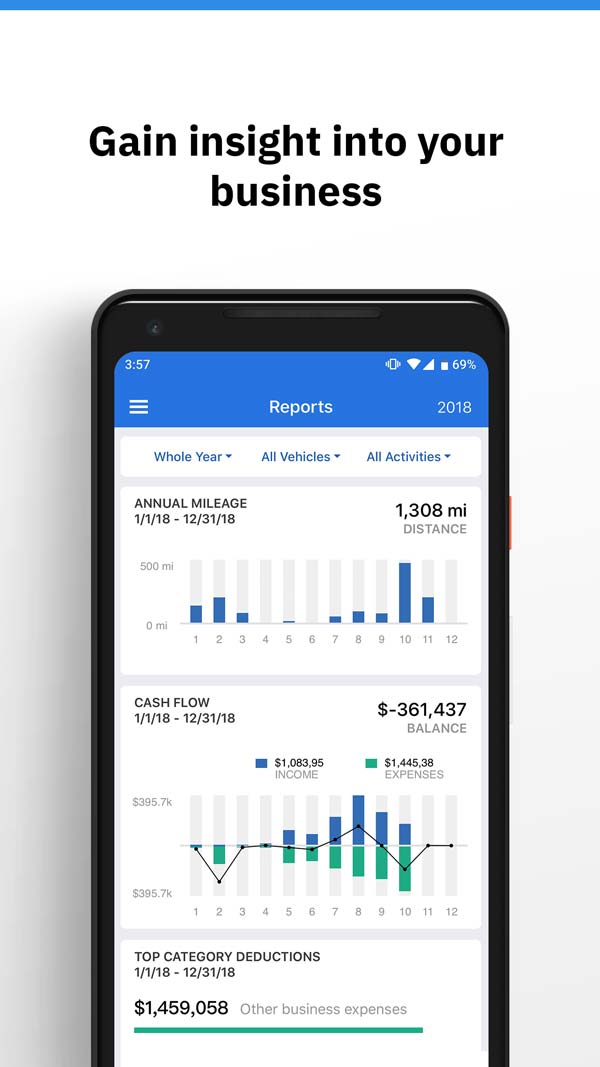

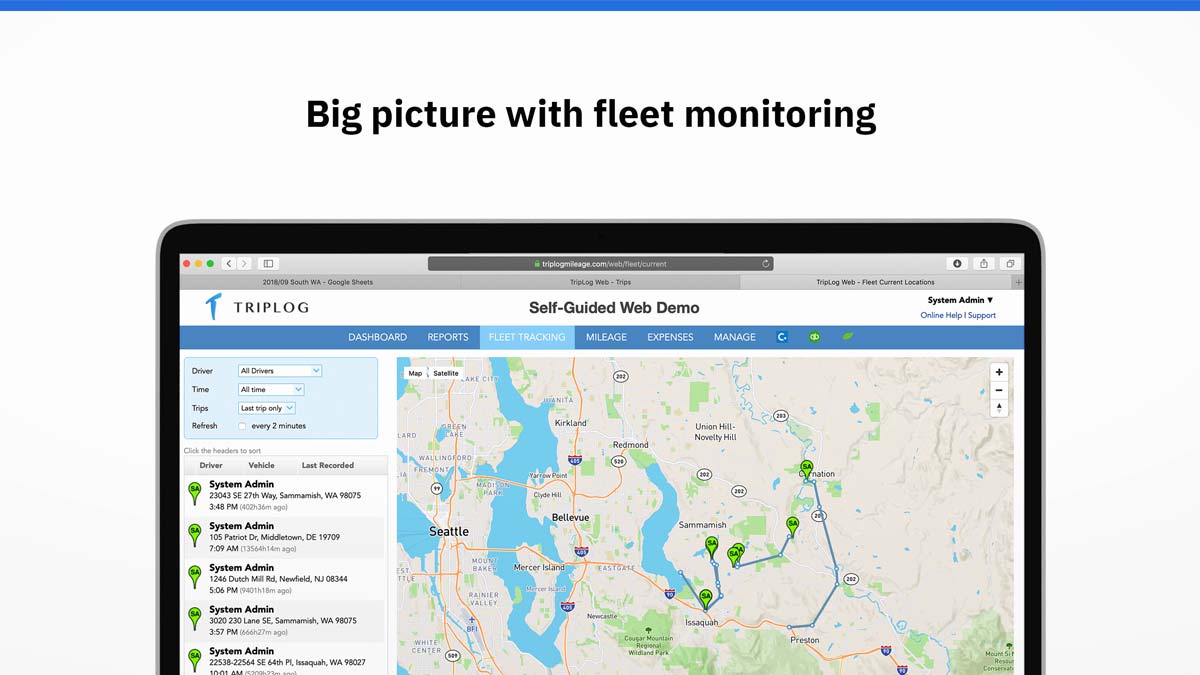

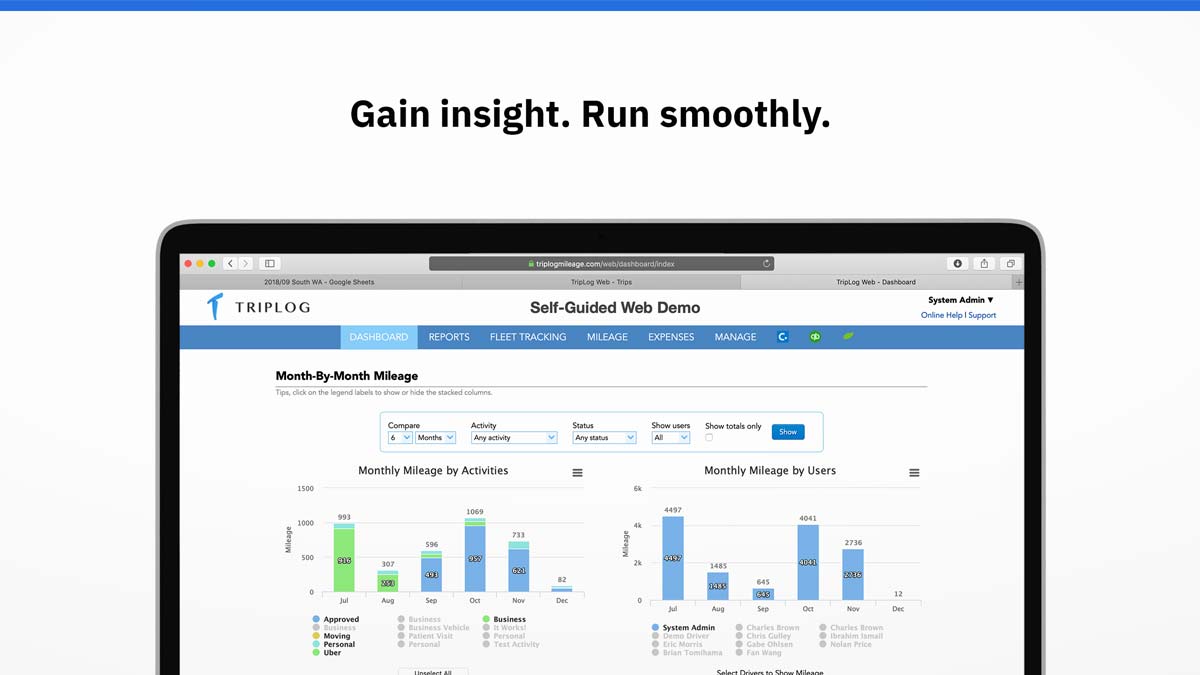

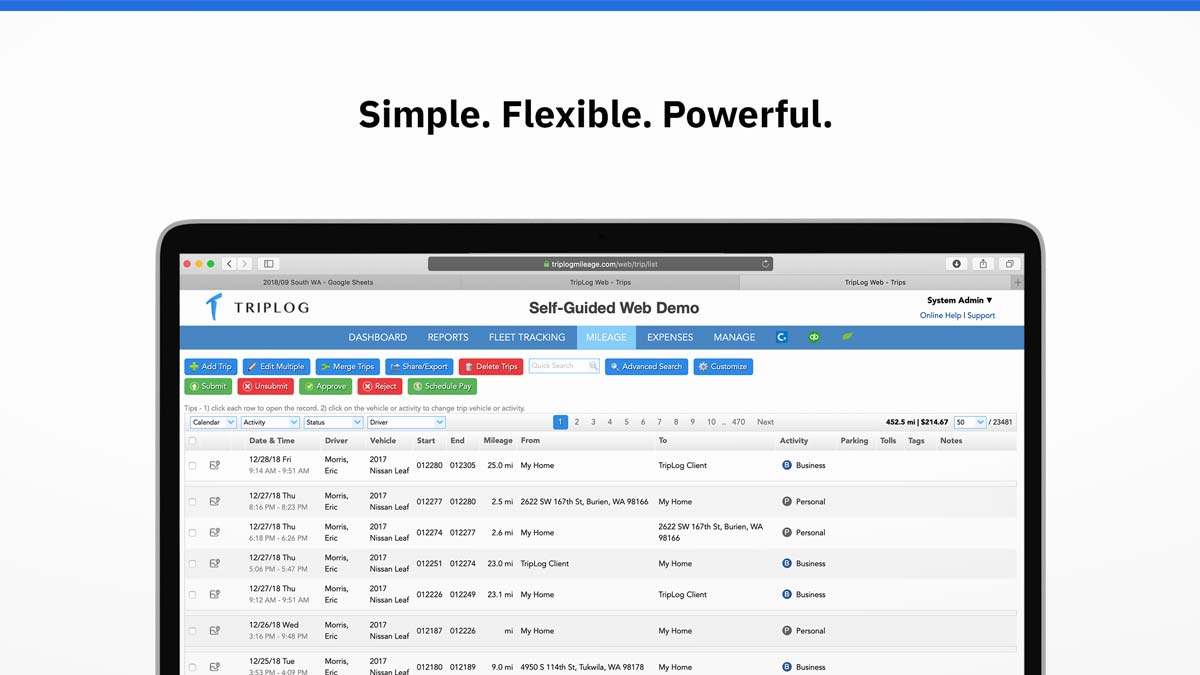

TripLog Web Dashboard and Mobile App Gallery

The most feature-rich automated mileage log tracker for your tax deductions. TripLog app automatically records trips and categorizes the mileage you drive based on your preferences. TripLog is completely customizable unlike other tracker apps on the market.

Mileage is just one of many expenses you can deduct. Other deductible expenses include fuel, parking, tolls, maintenance, insurance, lodging, meals, etc., all of which can be tracked using TripLog.

Upload Mileage to Xero as Bills

TripLog mileage tracking integrates with Xero’s billing features seamlessly. Easily upload the employee’s business miles to Xero as ‘Bills to Pay’ to reimburse them. TripLog also allows you to map TripLog users to Xero Contacts, choose the appropriate Xero Tax Rate and the Expense Account, or allow TripLog to create one for you.

Upload Mileage to Xero as Invoices

Creating mileage invoices for your clients within Xero is made easy by TripLog! To turn your mileage into a Xero invoice, simply map your TripLog mileage activities to Xero Contacts or pull Contacts from Xero as activities. Then, choose the appropriate Xero Tax Rate and the Revenue Account or allow TripLog to create one for you.

Connecting to Xero

- Please navigate to https://triplogmileage.com/web/xero/reimburseEmployees.

- Click ‘Connect to Xero’. A pop-up will then appear. In the pop-up, click the blue and white button labeled “Connect to Xero”.

- A new browser window will open. In the new window, please enter your Xero user email address and password in the appropriate fields and click “log in”.

- Select the Xero Organisation you would like to connect TripLog to (if you have multiple Xero organizations), then click “Allow access”.

What is Xero?

Xero is a world-leading online accounting software built for small businesses.

- Get a real-time view of your cashflow. Log in anytime, anywhere on your Mac, PC, tablet, or phone to get a real-time view of your cash flow. It’s small business accounting software that’s simple, smart, and occasionally magical.

- Run your business on the go. Use our mobile app to reconcile, send invoices, or create expense claims – from anywhere.

- Get paid faster with online invoicing. Send online invoices to your customers – and get updated when they’re opened.

- Reconcile in seconds. Xero imports and categorizes your latest bank transactions. Just click ok to reconcile.