- Products

Mileage

Expense

Time

Mileage

Expense

Time

- PartnersLearn more

Book a call with our experts

Book a call with our expertsDiscover how TripLog can drive time and cost savings for your company.

- SolutionsSolutions

TripLog is the market’s premier mileage and expense tracking solution. We cater to businesses of all sizes and industries.

Find out how much your company can save: - ResourcesTools

Learn about new features, tips & tricks, and how people have used TripLog to save thousands of dollars and man-hours.

Essential Reading:Resources - Pricing

- What’s new

Expense Tracking With TripLog

Give your employees the ability to submit, review, and approve expense reports with TripLog. Keep an organized record of your business’s transactions and generate detailed expense reports to help make sound decisions.

Starting at

$4/User/Mo

QUICK, EASY, PRECISE

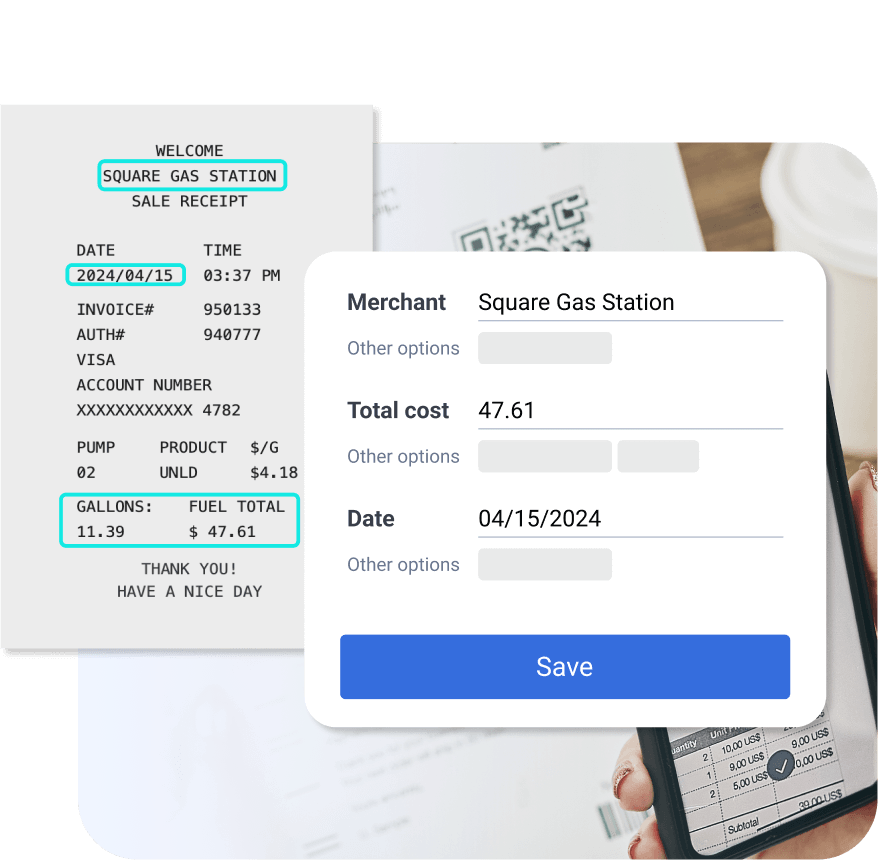

Automatic Photo Receipt Capture

Simply snap a photo of your receipt and the TripLog mileage tracker app will automatically fill in the details via optical character recognition (OCR). TripLog’s expense tracking allows you to categorize your transactions, giving you a complete picture of your bottom line.

APPEARANCES

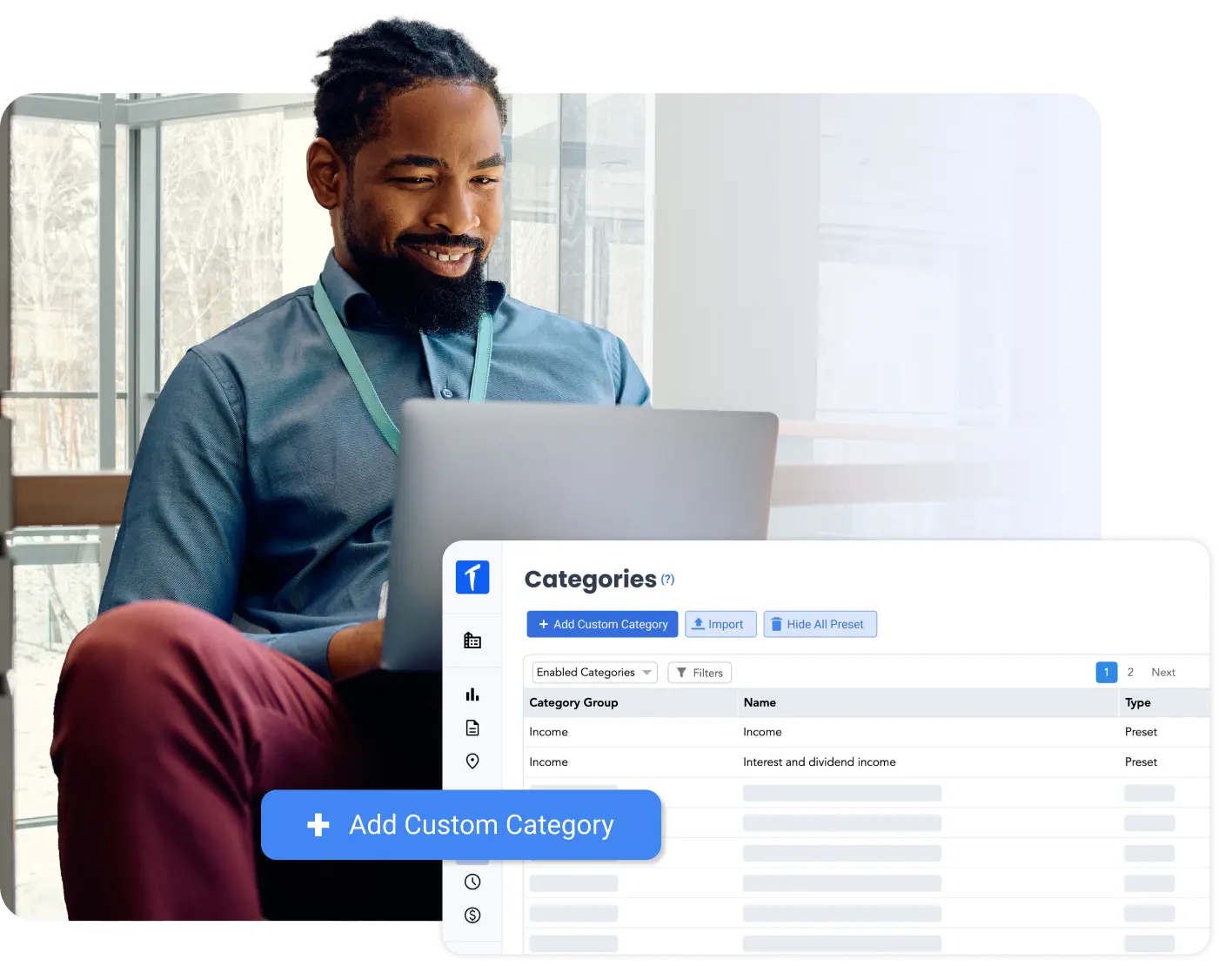

Streamlined Expense Management

With TripLog’s company mileage & expense tracking solutions, it’s never been simpler to enforce spending policies.

Easily assign custom tags and categories, managed from the back office, to each expense entry. They can be used to classify expenses for any business purpose, from cost codes to client-specific.

SIMPLICITY

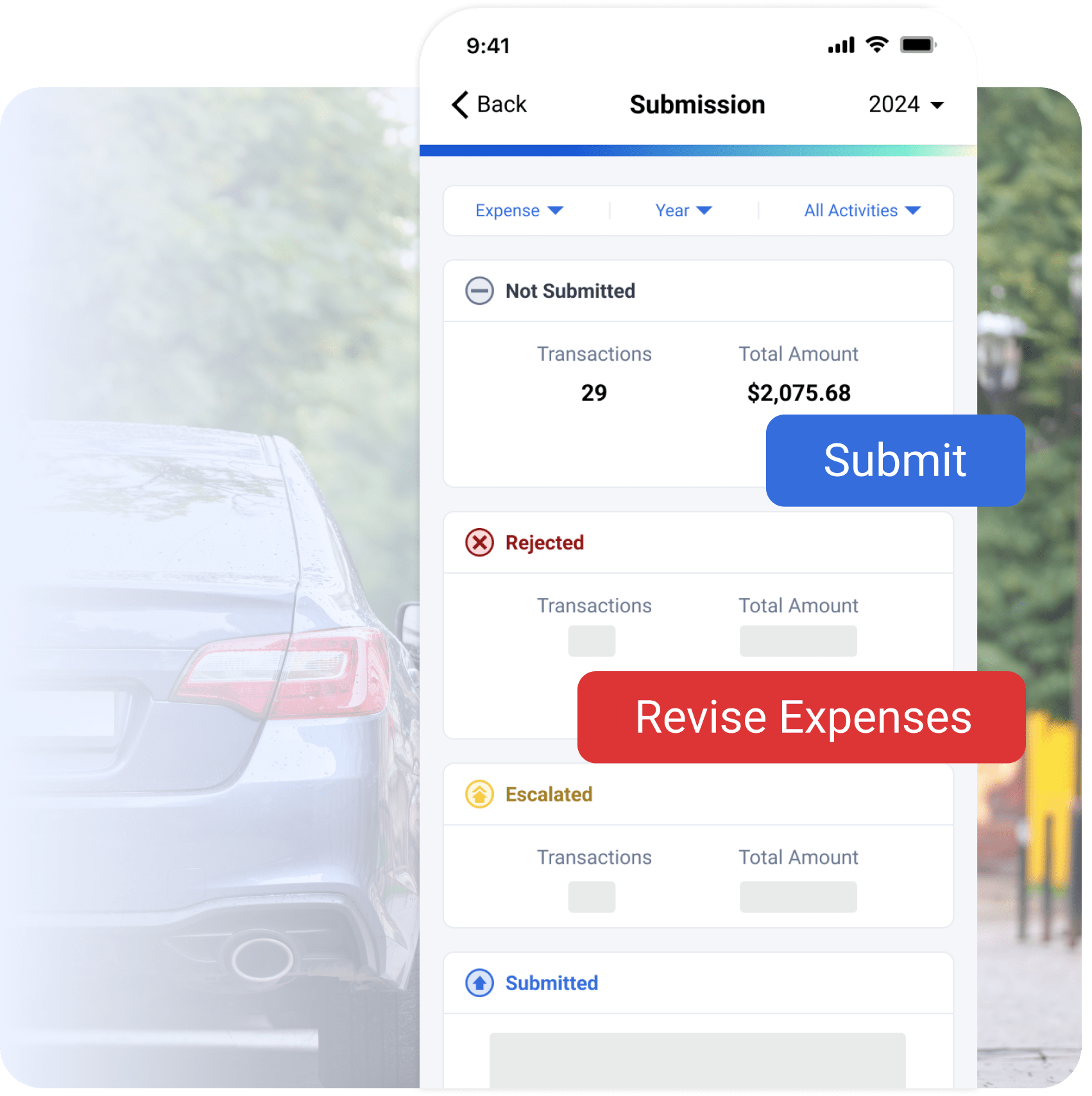

Submit With Just A Click

Say goodbye to workarounds, emails, and manual logs. Drivers can easily capture and submit their expenses for approval through TripLog.

More than 1/3 of employees forget to claim their expenses. TripLog streamlines your expense management process, improving your team’s overall satisfaction.

EXPENSES

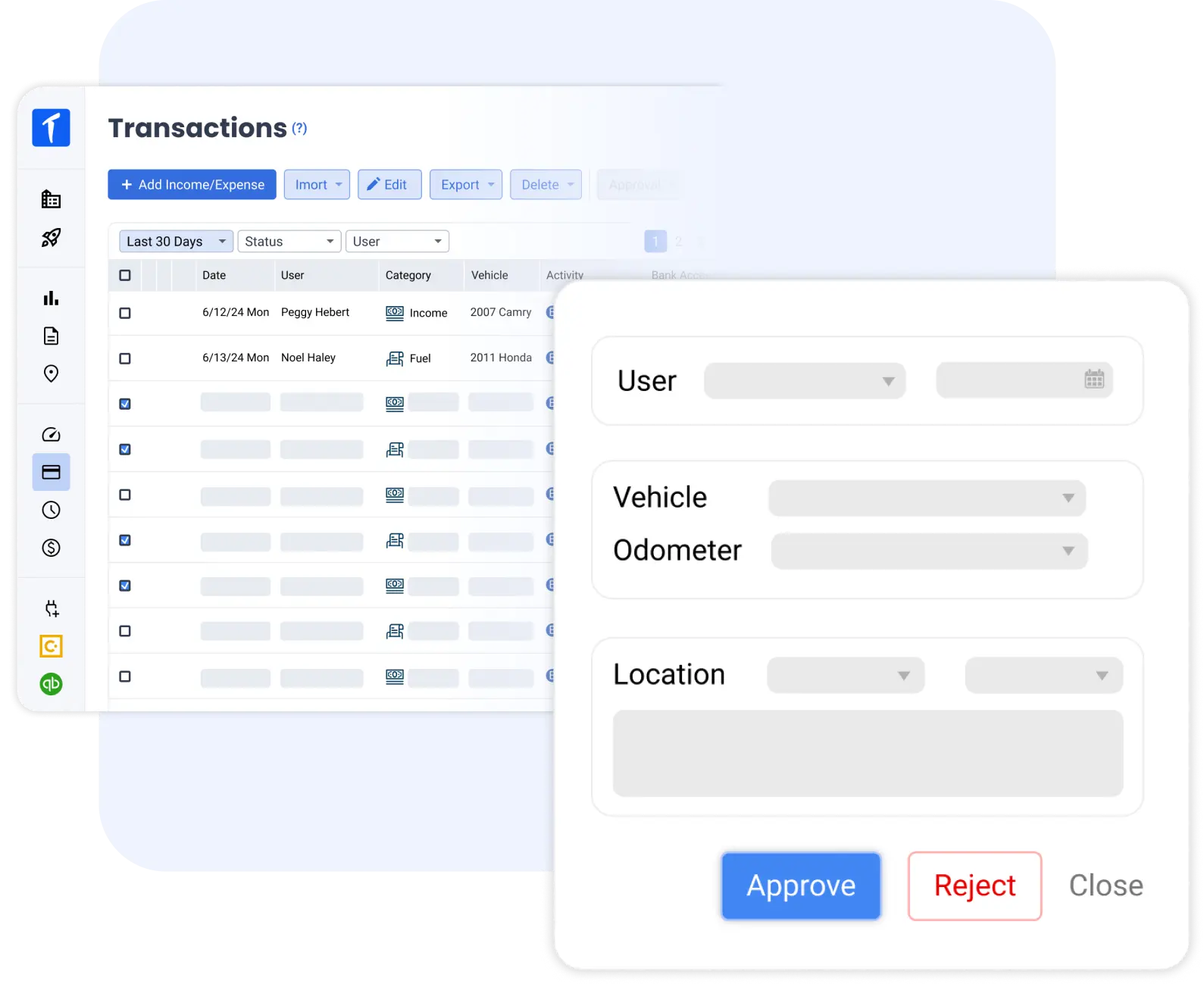

Approve Expenses With Confidence

Managers can easily review and approve expense reports from the intuitive TripLog dashboard, and get valuable reports on expenditure.

With our easy-to-understand dashboard interface, you can see all of your expense data in one convenient place.

INTEGRATIONS

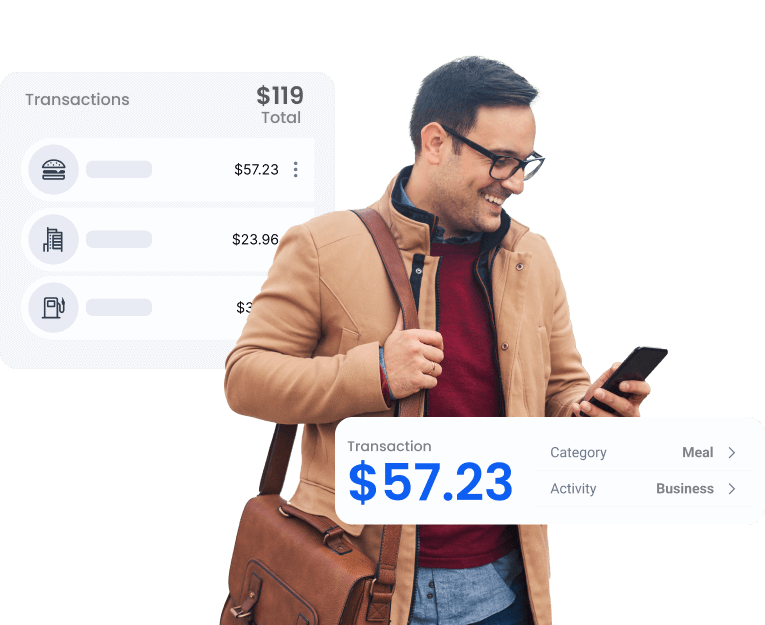

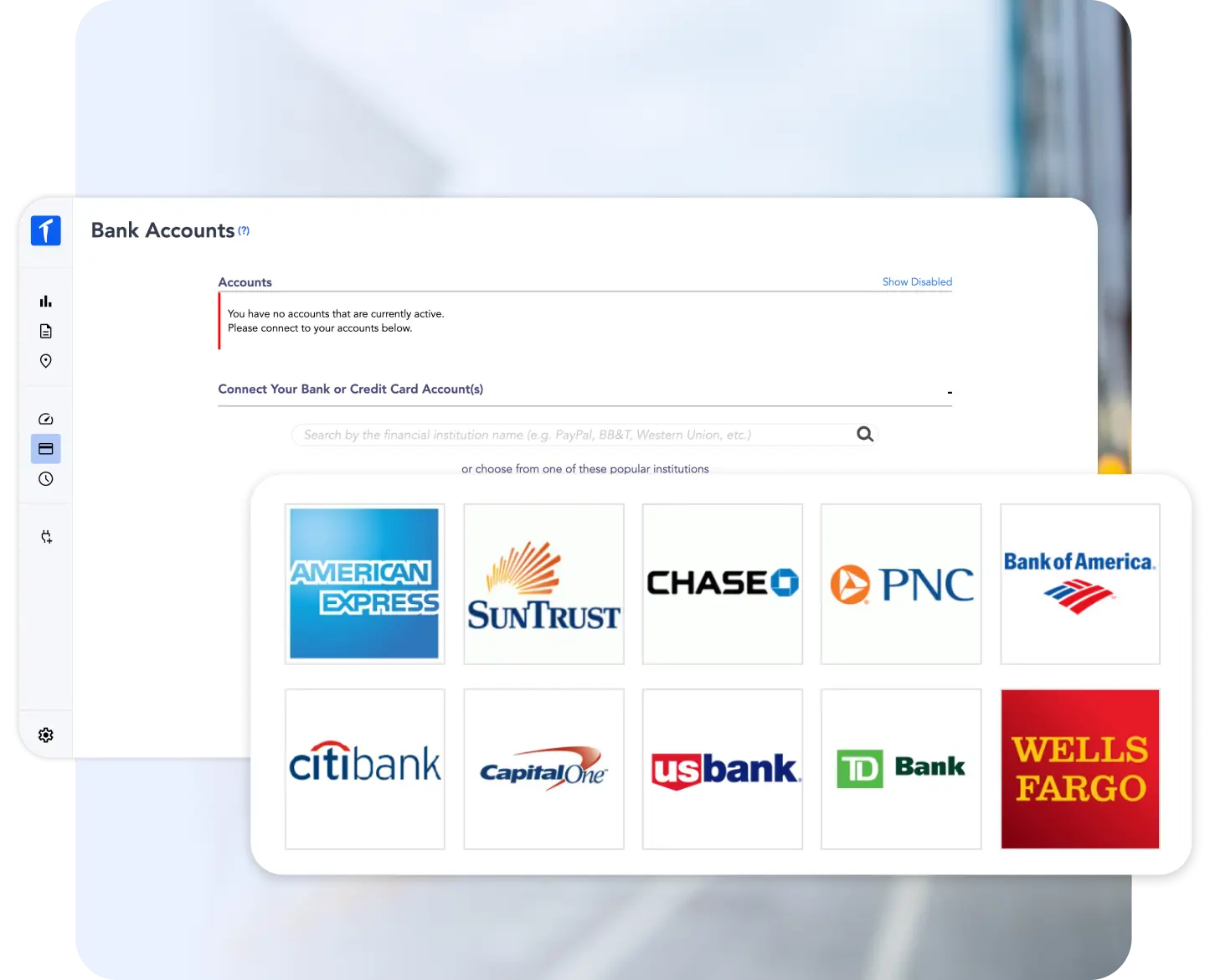

Bank and Credit Card Integration

Manage and reconcile business expenses by adding your business credit card or bank account. Automatically download bank or credit card feeds from over 10,000 financial institutions.

Tax Savings

With the ability to track tolls, parking, fuel, meals and other business expenses, you always have an IRS-compliant summary of your travel expenses for audit-proof tax returns or mileage reimbursement. TripLog also reduces your labor costs by seamlessly integrating with popular accounting, payroll, and travel management software solutions – as well as securely downloading bank and credit card feeds – so you never have to waste time doing redundant data entry. TripLog allows your company to easily implement spending policies, manage all expense information and data in one convenient dashboard, and easily process expense reports.