- Products

Mileage

Expense

Time

Mileage

Expense

Time

- PartnersLearn more

Book a call with our experts

Book a call with our expertsDiscover how TripLog can drive time and cost savings for your company.

- SolutionsSolutions

TripLog is the market’s premier mileage and expense tracking solution. We cater to businesses of all sizes and industries.

Find out how much your company can save: - ResourcesTools

Learn about new features, tips & tricks, and how people have used TripLog to save thousands of dollars and man-hours.

Essential Reading:Resources - Pricing

- What’s new

+

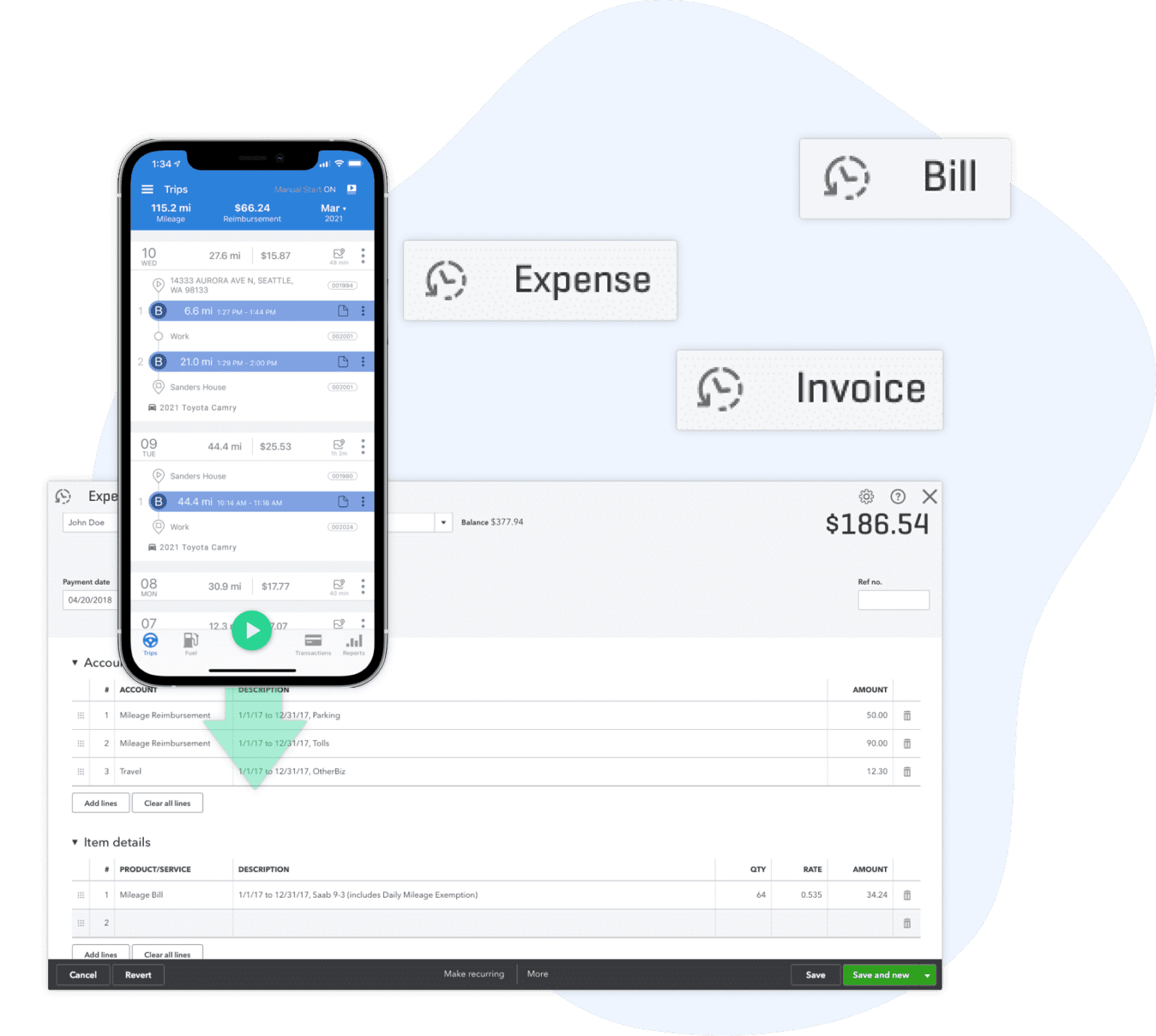

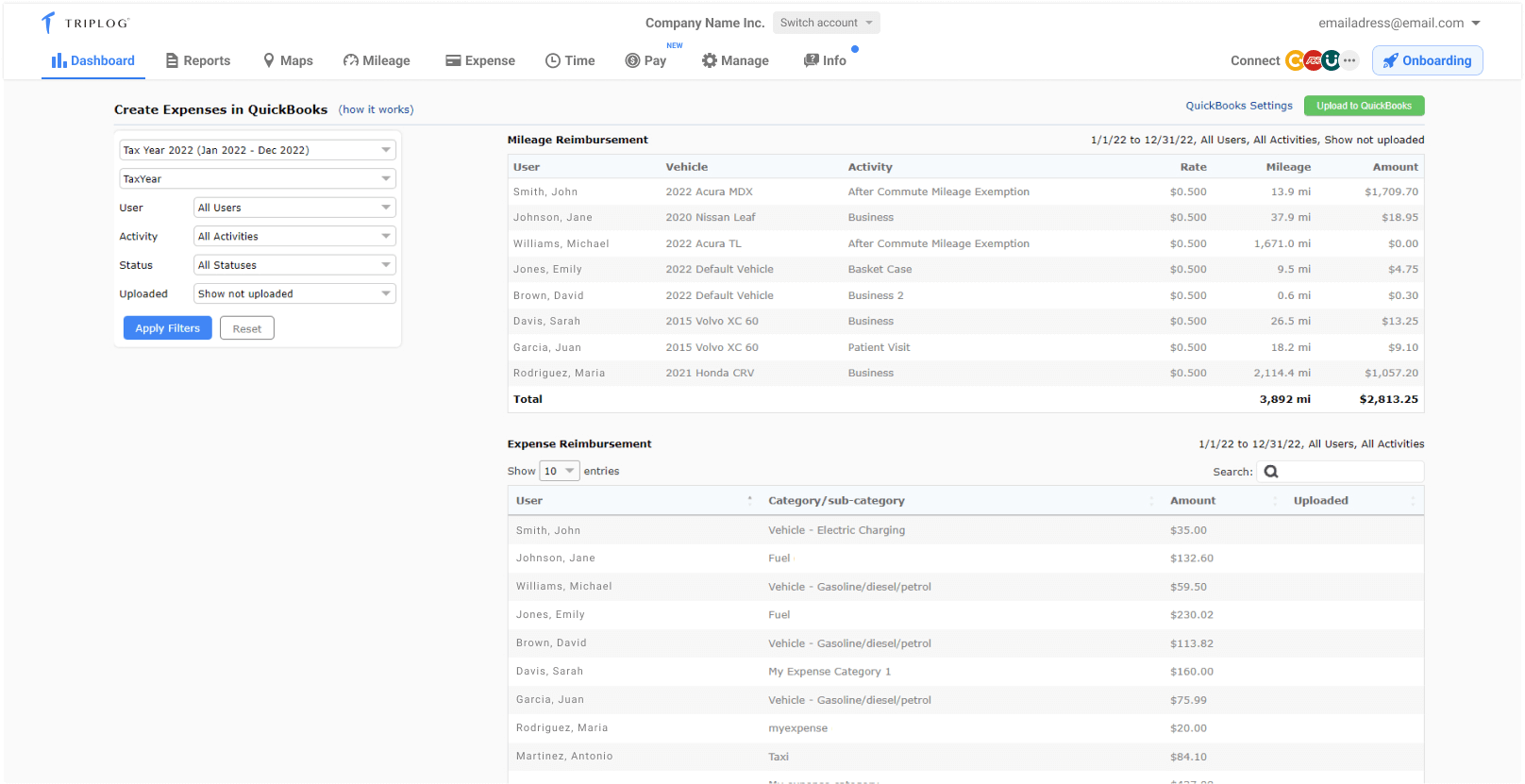

TripLog Brings Automatic Mileage Tracking Into QuickBooks Online

Upload Mileage and Expenses to QuickBooks

Connecting QuickBooks to your TripLog account is easier than ever! Simply log in to your QuickBooks online account and allow access to your TripLog account.

With our QuickBooks integration, you can easily bill, expense, or invoice your team's mileage for quick and easy reimbursements.

Mileage Tracking for Quickbooks

TripLog Makes Mileage Tracking Easy for QuickBooks Users.

IRS Compliant

TripLog specializes in all IRS-compliant mileage programs, including car allowance, smart mileage rates, fuel cards, and fixed and variable rate reimbursements. TripLog also includes every field required by the IRS, as well as the UK’s HMRC and Canada’s CRA.

Maximize Your Tax Deduction

TripLog is the perfect mileage tracker for independent contractors and small business owners. TripLog’s mileage tracker gives drivers detailed reports straight from the app. See how much you’re driving, spending, and earning back.

Easy Fuel Tracking

With TripLog, it couldn’t be simpler to track your team’s fuel purchases. They can enter what they spent manually, or simply take a photo of their gas receipt and the app’s OCR capabilities will fill in the rest.

Simplify

Why TripLog

Manually logging and processing mileage reports can eat up otherwise productive employee hours, not to mention the costs of over-reimbursement via improper mileage logs.

TripLog automatically starts tracking you and your team’s mileage when the car starts driving and stops when they stop. By eliminating time-consuming and inaccurate manual mileage logs, TripLog can save your company thousands in reimbursement costs per employee.

TripLog starts tracking when you start driving and stops when you stop. In addition, TripLog can automatically classify trips with set business hours, making accurate business mileage logging even simpler. With over eight ways to track mileage, TripLog you the flexibility you need.