Company mileage reimbursement simplified.

Bolster company policy enforcement, simplify employee reimbursements, and move beyond inaccurate manual mileage logs.

Discover how TripLog can drive time and cost savings for your company.

TripLog is the market’s premier mileage and expense tracking solution. We cater to businesses of all sizes and industries.

Find out how much your company can save:

Learn about new features, tips & tricks, and how people have used TripLog to save thousands of dollars and man-hours.

Bolster company policy enforcement, simplify employee reimbursements, and move beyond inaccurate manual mileage logs.

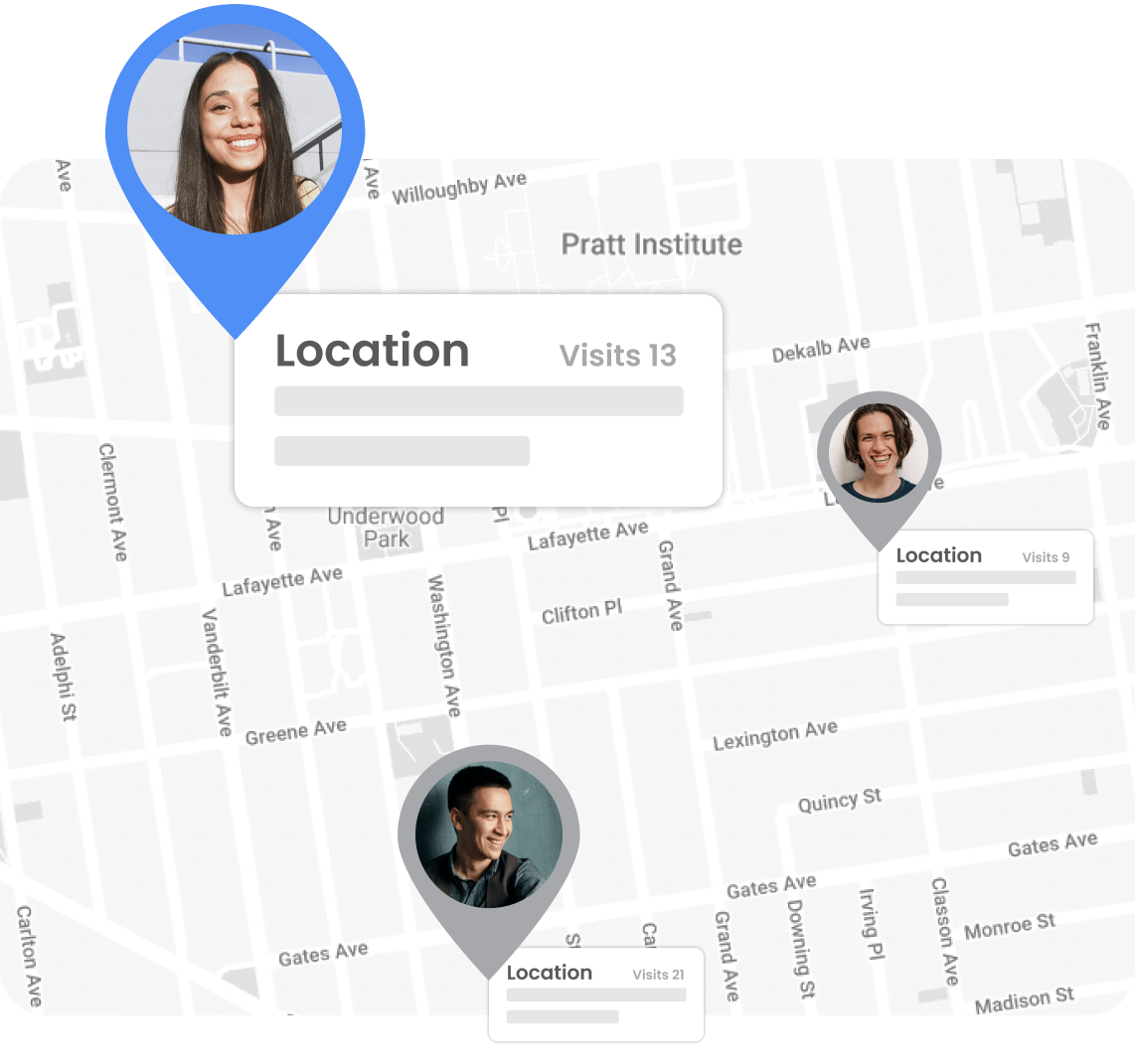

MODERN MILEAGE TRACKING

The TripLog app gives your team a sleek, private, and easy-to-use GPS-based solution for tracking their mileage. TripLog starts tracking when your team starts driving, so your drivers can focus on their work, not their mileage.

Prefer manual tracking? TripLog has you covered there, too.

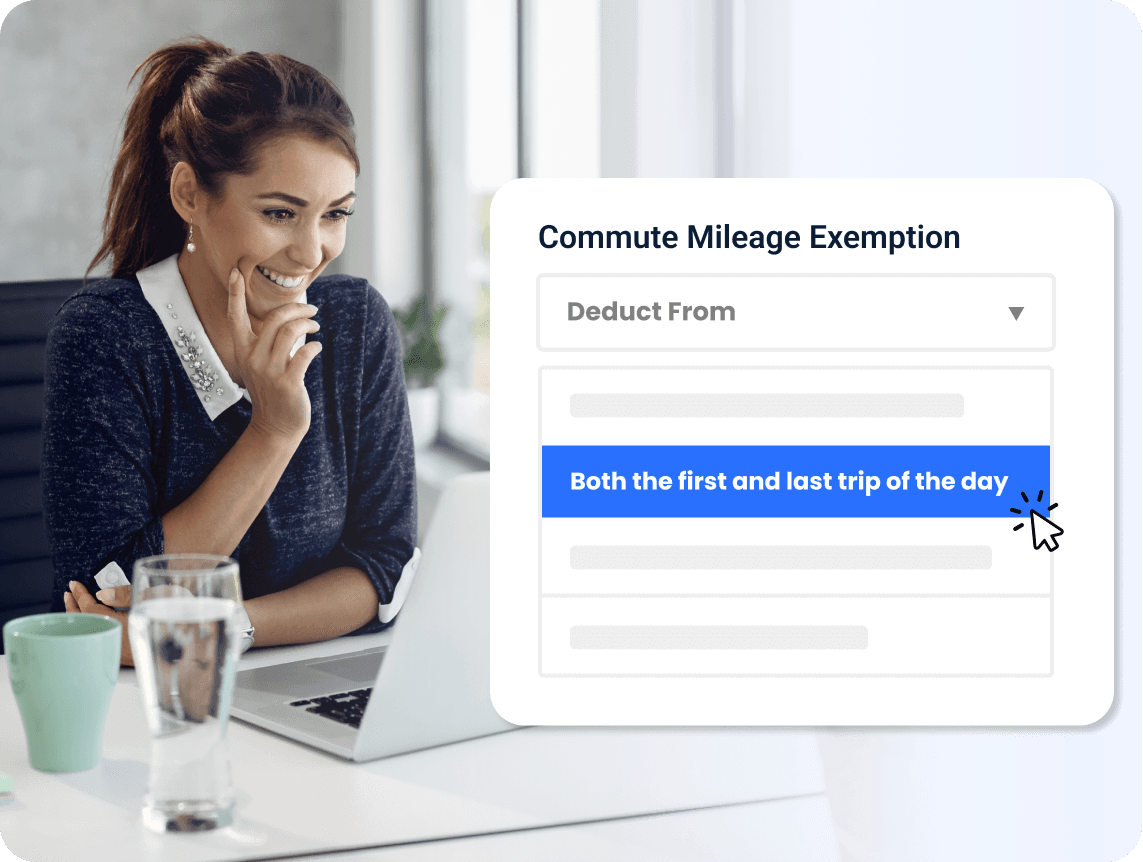

CREATE CUSTOM POLICIES

TripLog is as feature-rich as it is customizable. Easily set up automation, turn features on and off, and take full control of your team’s mileage and expenses, ultimately improving your team’s organizational efficiency.

You can also set custom mileage and expense policies, such as commute exemptions, frequent trip rules, and shortest distance calculations.

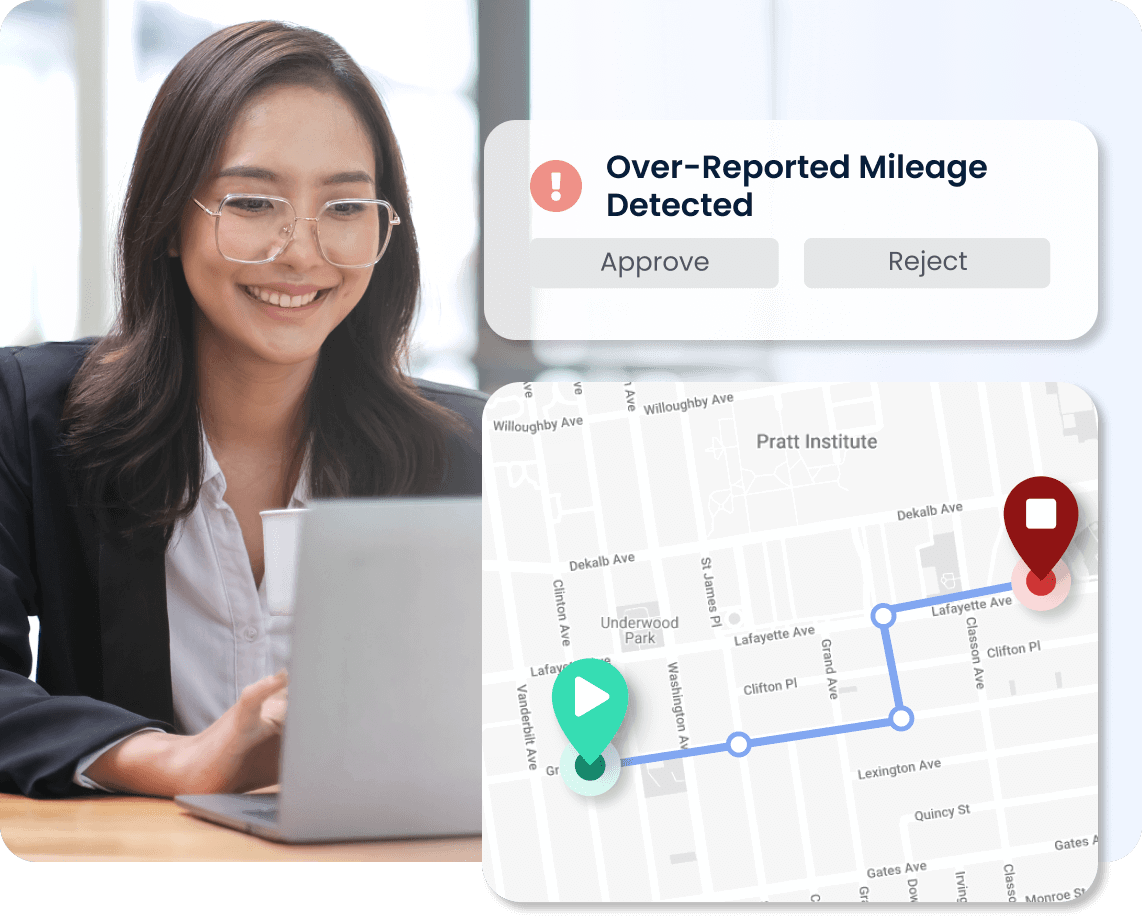

SAVE TIME

Paper logs are wasting a lot of time for your company each day. Plus, drivers are known to over-report their mileage by as much as 28% on average.

As TripLog automatically compares trips with Google Maps, your company can enforce policies and say goodbye to incorrect mileage for good.

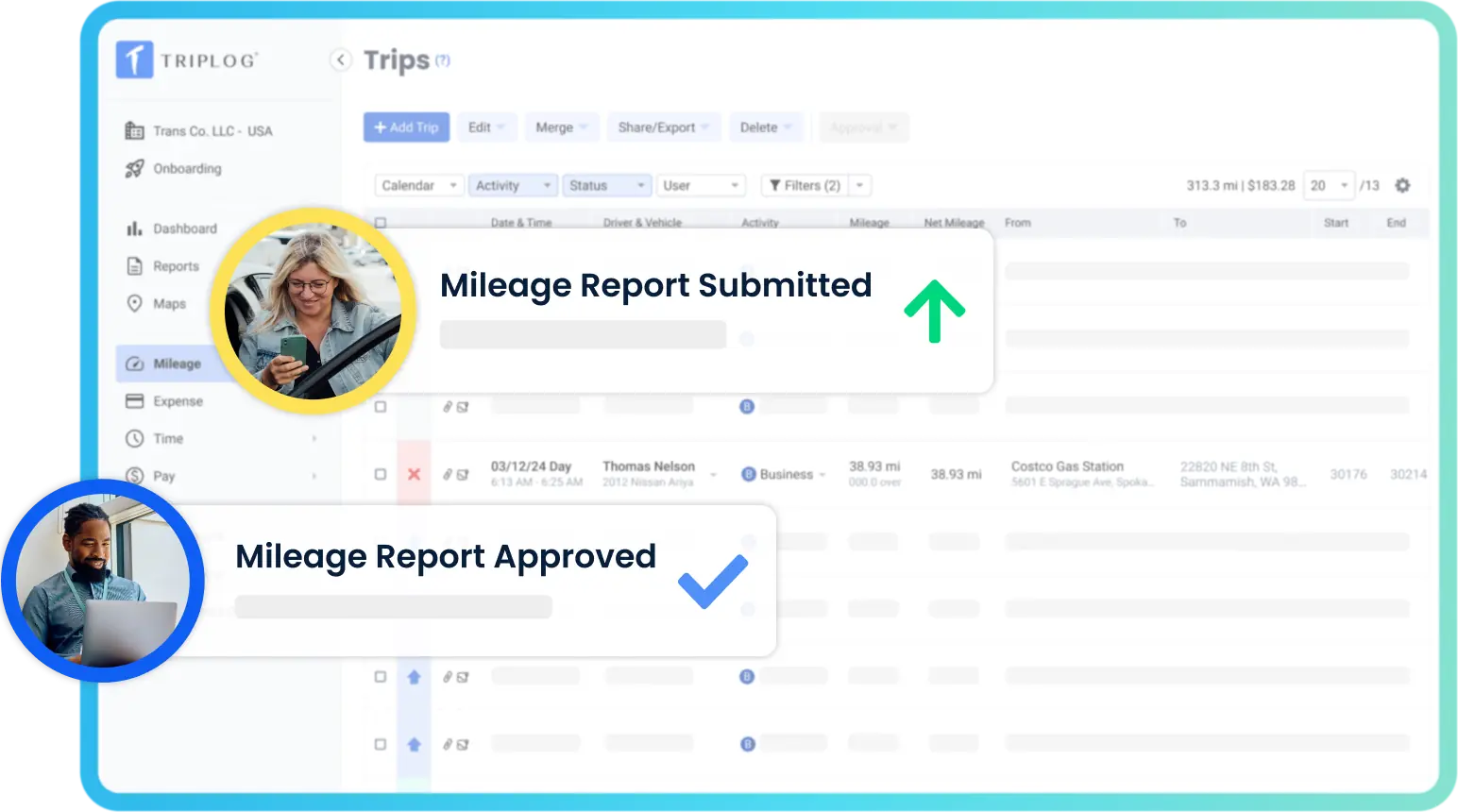

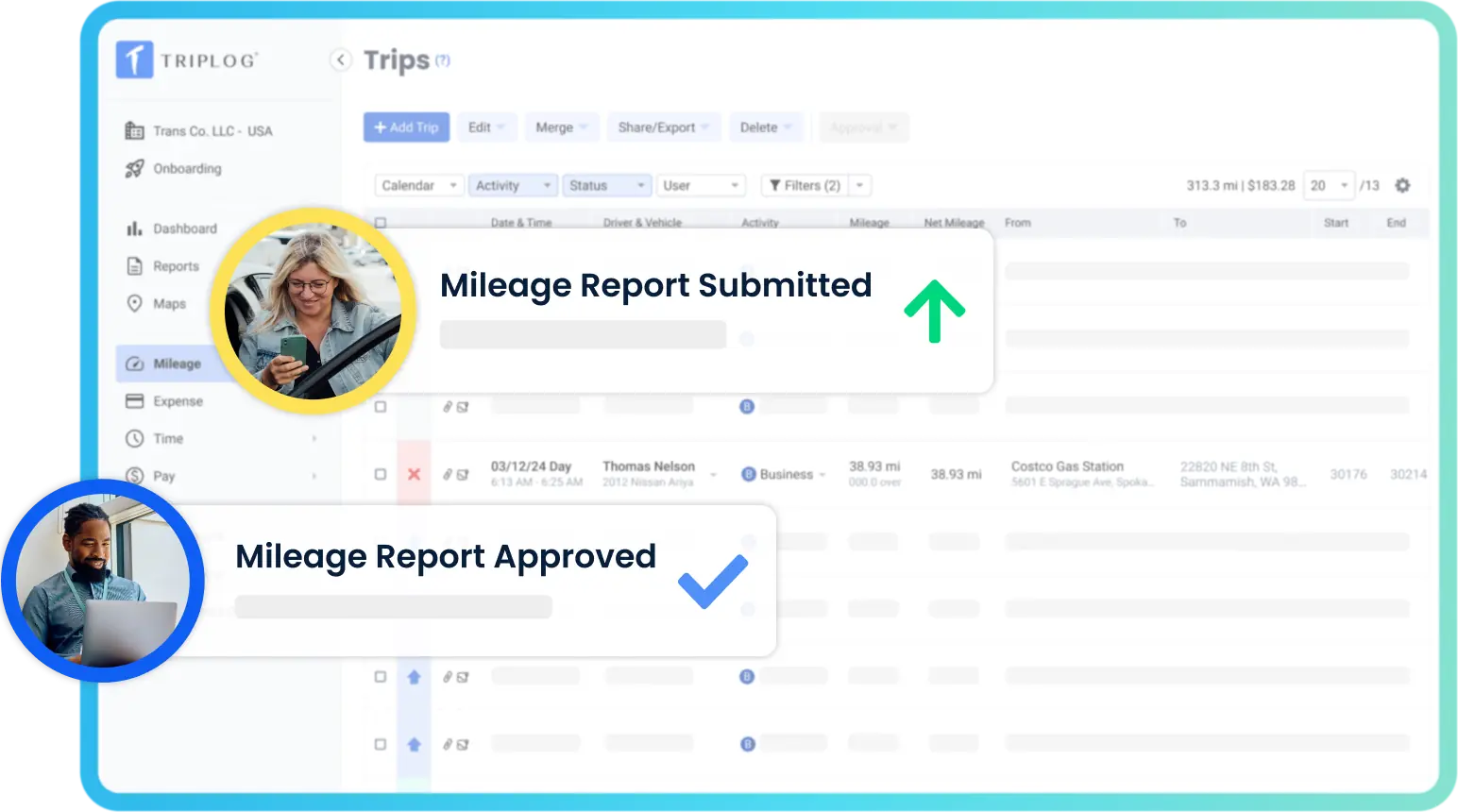

POWERFUL REPORTING

Unlike other mileage and expense tracking solutions, TripLog’s web dashboard provides you with the ability to hold your employees accountable.

COMPANIES SAVE THOUSANDS

Experience the TripLog difference, where we revolutionize the way businesses handle mileage tracking and expense reimbursement. Our sophisticated solutions effortlessly blend advanced technology, user-centric design, and powerful analytics to streamline traditionally tedious processes. At TripLog, we are more than just a product – we are a committed partner in propelling your business forward.

Using outdated manual mileage logs can cost businesses thousands of dollars per year in lost time and incorrect reimbursements. See how much TripLog can help you save!

Number of drivers

Average miles daily per person

Number of trips daily

Cents-per-mile

Annual mileage reimbursement costs based on the numbers you provided.

Annual Mileage Reimbursement

50 mi/day x 100 drivers x $0.70 (5 days x 50 wks)

$675,000

This is the inline help tip! You can explain to your users what this section of your web app is about.

According to research, on average employees inflate the mileage by 25% when self reported.

Estimated Reimbursement Savings

$168,750

People on average spend 2 minutes on manually recording trips.

Manual Entry Hours

2 mins x 10 trips/day x 100 drivers (5 days x 50 wks)

8,334 hr

Taking national average $25 hourly rate.

Estimated Labor Savings

Avg. $25/hr x Manual Entry Hours

$208,334

Your Company

(Labor Savings + Reimbursement Savings) / Number of Drivers

$4,167

See how TripLog works, ask questions, and explore your potential savings!

Start automatically tracking your mileage today to never miss another deductible mile. Try the #1 mileage tracker for free!

(4.8 out of 5)