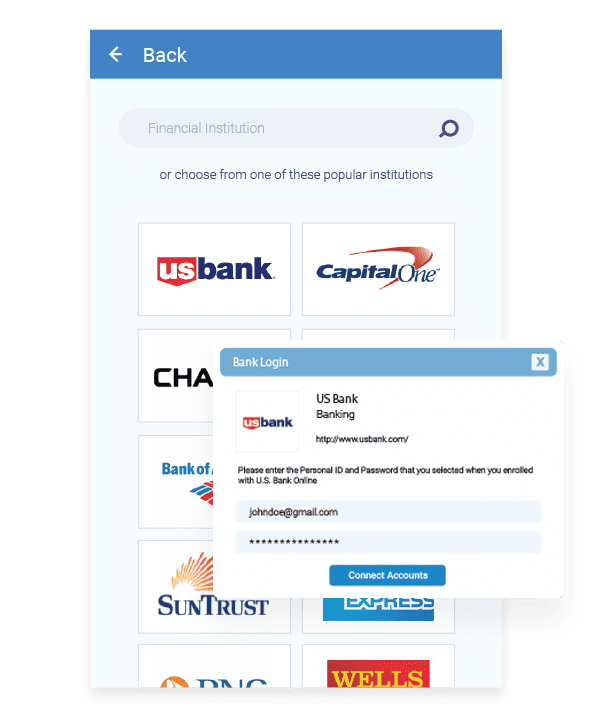

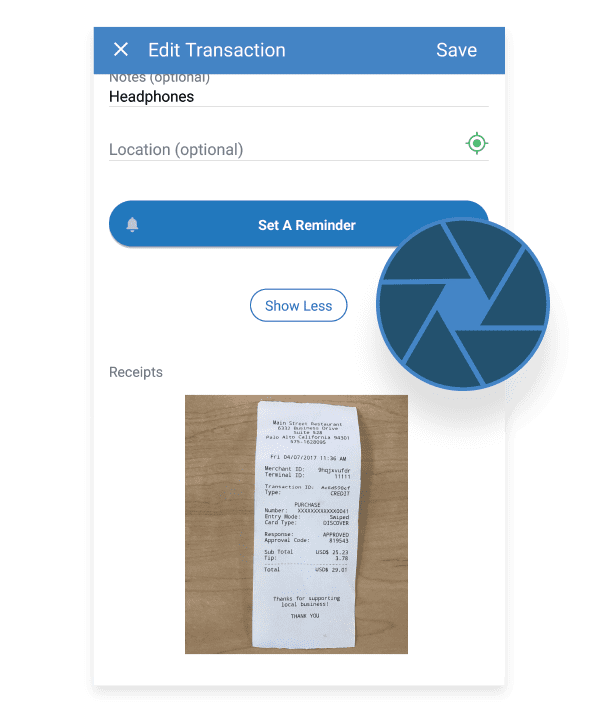

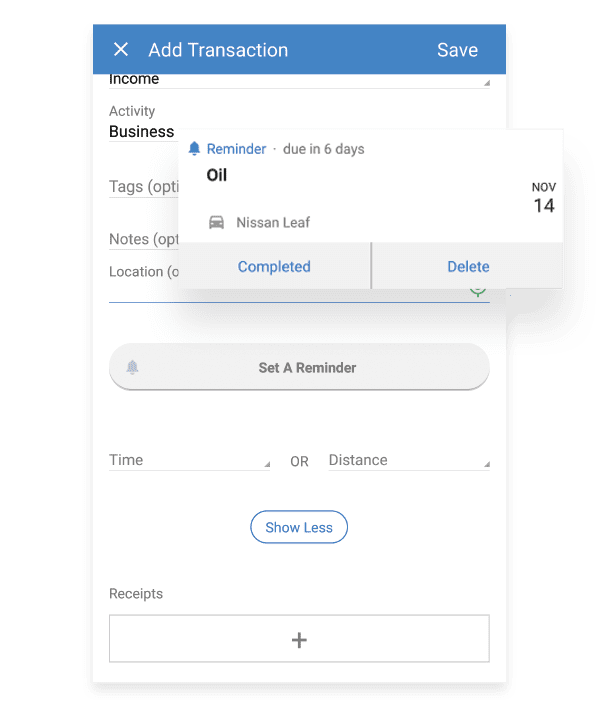

Ever wonder how to get the most tax benefits out of the gig economy? From tolls and parking to car washes and water bottles, we cover them all. Simply snap a photo of the receipt, or better yet, connect to your bank and credit cards and let us automatically download all the tax-deductible expenses.

As a realtor, you no doubt have a lot of paperwork to file and organize. Why not leave the tedious expense tracking to TripLog? From advertising and marketing to association fees, licensing, and gifts, many of your major expenses are tax-deductible. Maximize your tax deductions by taking advantage of TripLog’s bookkeeping and auto-classification features. Make tax preparation like a breeze.

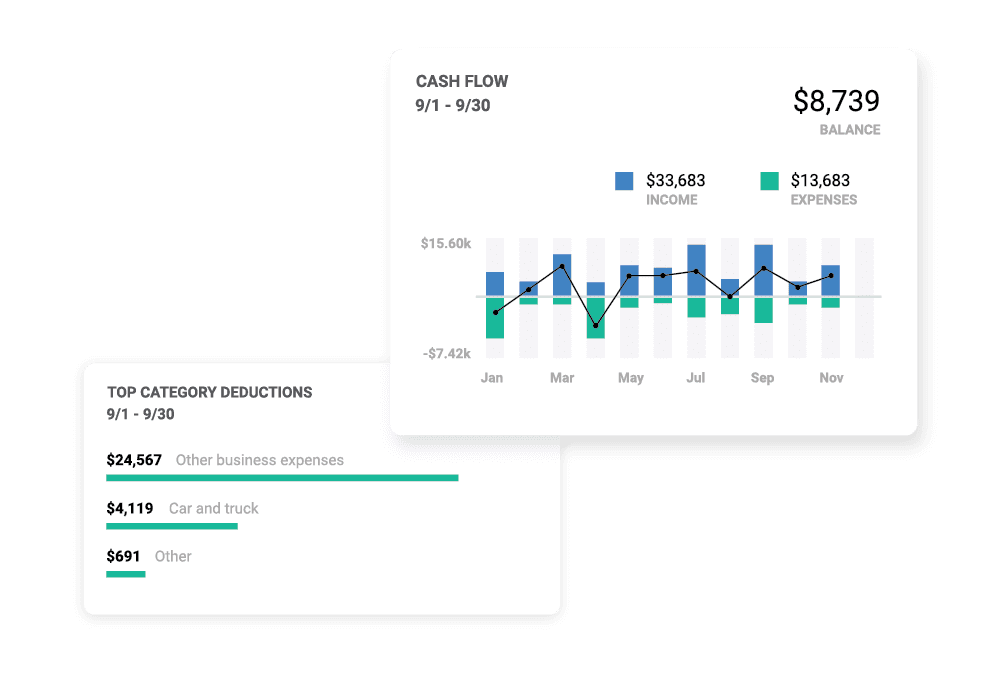

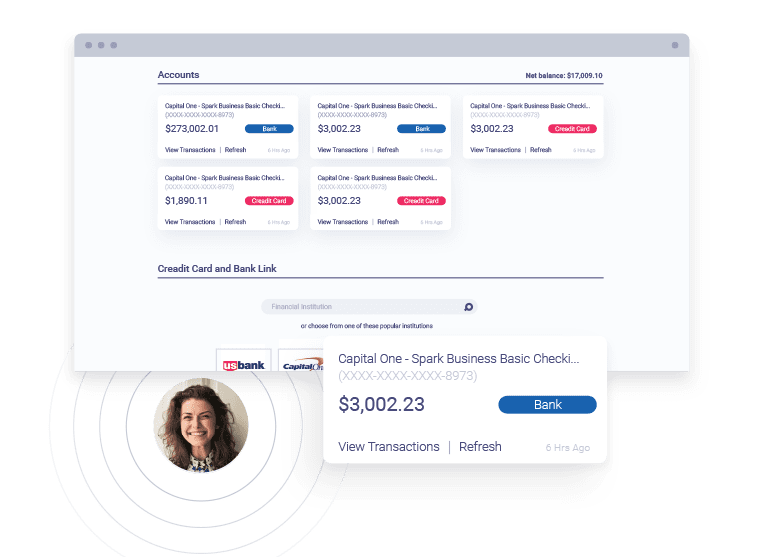

No matter how you choose to run your small business, either as a self-employed freelancer or a small business with a few employees, it’s important to get a handle on your books by tracking your mileage, business income, and expenses. With TripLog’s new bookkeeping feature, you can easily track vehicle mileage, securely download bank transactions, seamlessly integrate with QuickBooks Online, and confidently maximize your tax deductions.

TripLog is loved by tens of thousands of tax professionals because of its ease-of-use and IRS compliant reports. Now, accountants and bookkeepers can also use TripLog for their clients in a similar way as QuickBooks Online Accountants. With our new “TripLog For Accountants” feature, you can access all your clients’ reports on a single dashboard and choose to offer TripLog as a value-added service to your practice.