Free Printable Excel & PDF

Mileage Log Templates

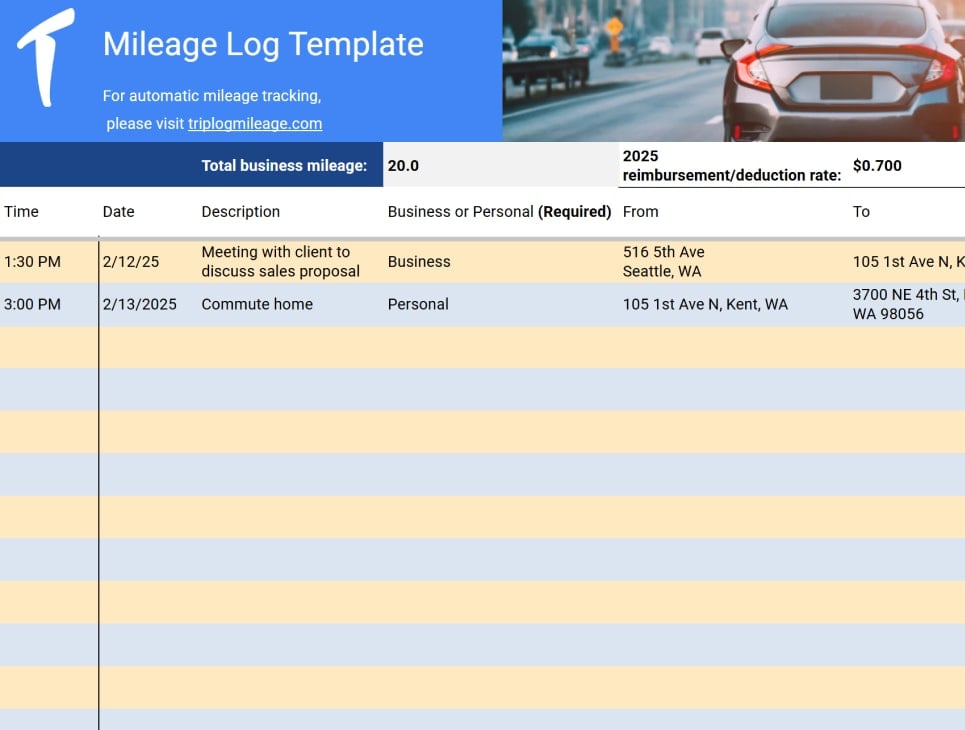

Whether you’re tracking your mileage to maximize your tax refund or to claim a reimbursement from your work, you’re going to need an easy-to-use logging method in order to get every dollar you’ve earned. If you’re not ready to switch to a modern mileage tracker app, you can download our pre-built mileage log templates in either Excel (which you can import into Google Sheets) or PDF!

FREE DOWNLOAD

Free Excel/PDF Self-Employed Mileage Log For Taxes Template Download

This free downloadable mileage log is perfect for Uber drivers, DoorDash deliverers, and any other self-employed worker who uses their car for work. Tracking your mileage can save you thousands on your taxes (even more if you use an automatic mileage tracker app!).

FREE DOWNLOAD

Free Excel/PDF Company Mileage Reimbursement Form Template Download

If you’re an employee who uses their car to conduct business on behalf of a company or you’re a manager/owner with a team of mobile employees, tracking mileage is an absolute must. Download our free company mileage log template to make your mileage reimbursement process simpler!

How to Use These Mileage Log Templates

Our mileage log templates are not only convenient but also incredibly user-friendly. Designed with custom Excel code, these templates take the hassle out of mileage tracking. Just enter your odometer readings, and the sheet does all the number-crunching for you!

Important Steps:

- Purpose Column: For accurate business mileage calculation, you must enter “Business” in the “Purpose” column. Failure to do so may result in inaccurate totals.

- Minimum Information: If you’re using these logs for tax reporting, the IRS requires specific data for each business-related trip. This includes the trip’s mileage, date, destination, and purpose. Neglecting any of these details could complicate matters during an audit.

- Year’s Total Mileage: In addition to individual trip data, you’ll need to keep track of the year’s total mileage. Our template makes this effortless by automatically summing up your entries.

- Personal Trips: While the focus is often on business mileage, it’s crucial to document your personal trips as well. This provides a comprehensive record that may come in handy for various purposes, including potential tax deductions for business use of a personal vehicle.

If you need additional lines, simply copy and paste as many blank lines as you want!

By following these guidelines, you’ll have a robust, IRS-compliant mileage log that not only streamlines your record-keeping but could also save you significant time and money down the line. Happy logging!

Wait! Are you ready for a modern solution?

Manual mileage logs are costing you and/or your team dozens of labor hours per month.

Schedule a call with us to see how TripLog can give you those hours, and thousands of dollars in additional savings, back to your organization!