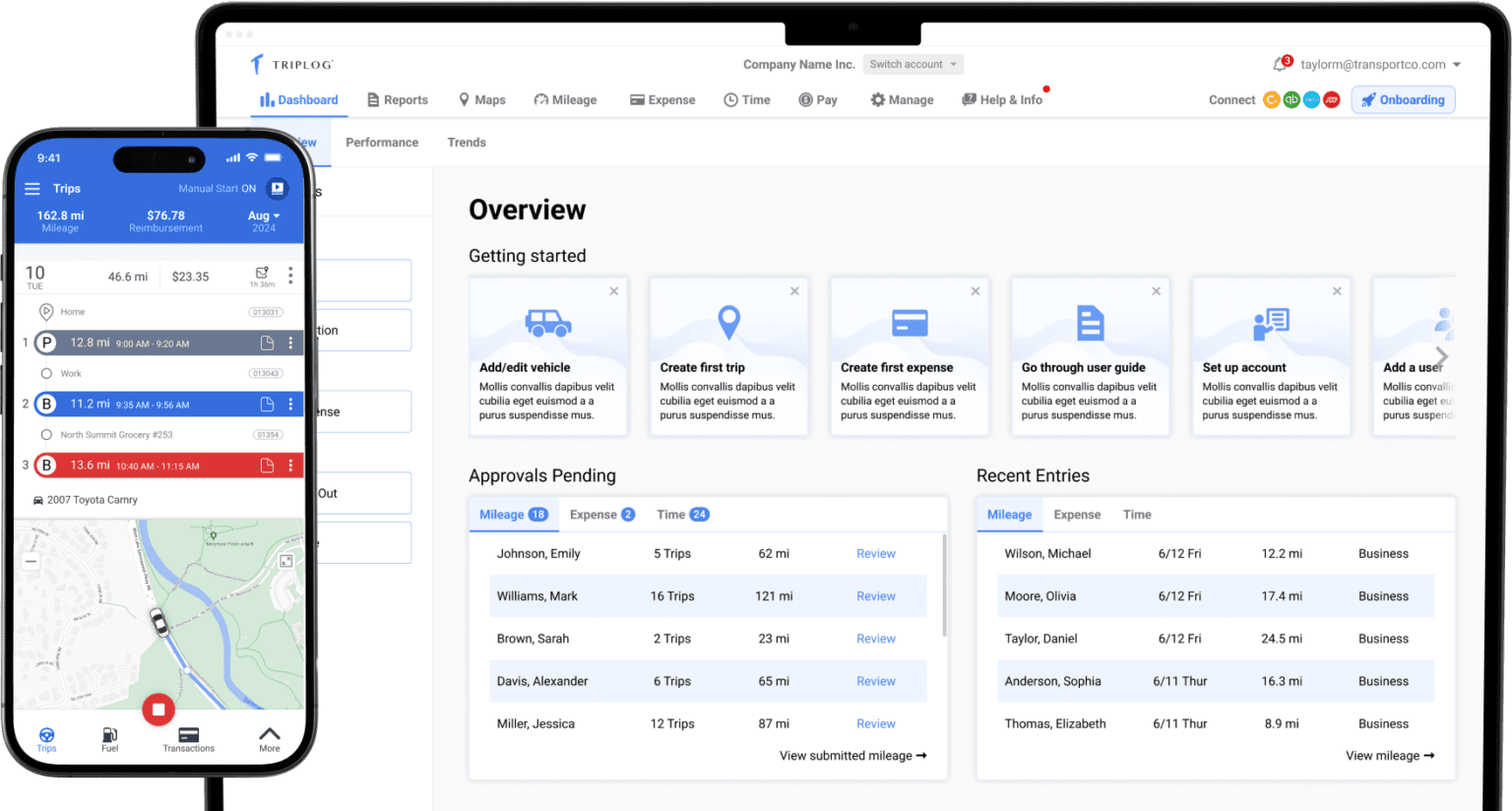

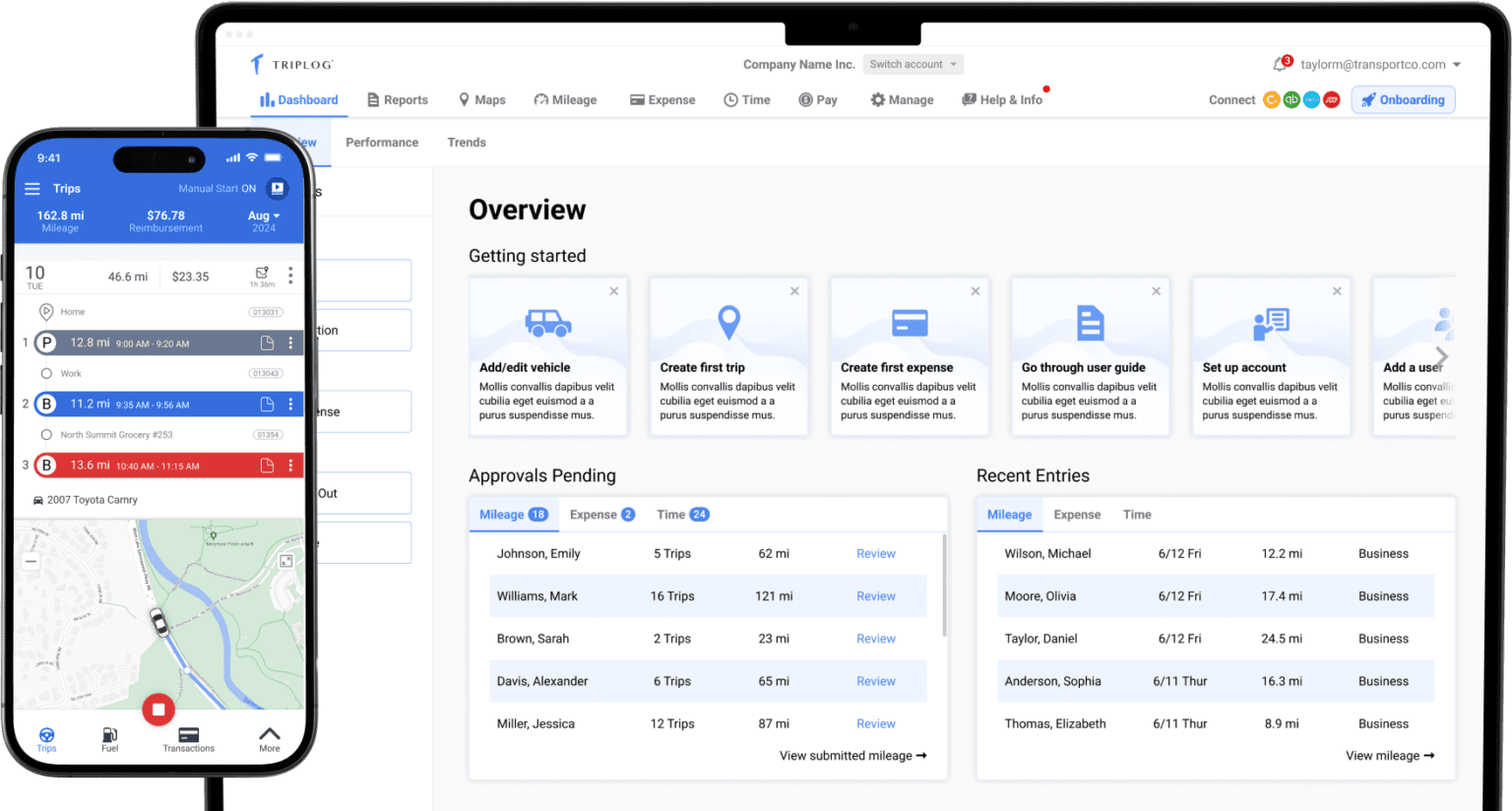

The #1 Automatic Mileage Tracking App

Ditch manual mileage logs and make reimbursing your team’s mileage and expenses simple.

Welcome to Modern Mileage Tracking.

Automatic Mileage Tracker App

TripLog automatically tracks your mileage, making mileage reimbursement and keeping a mileage log for taxes a breeze. TripLog is the market’s best mileage tracker app.

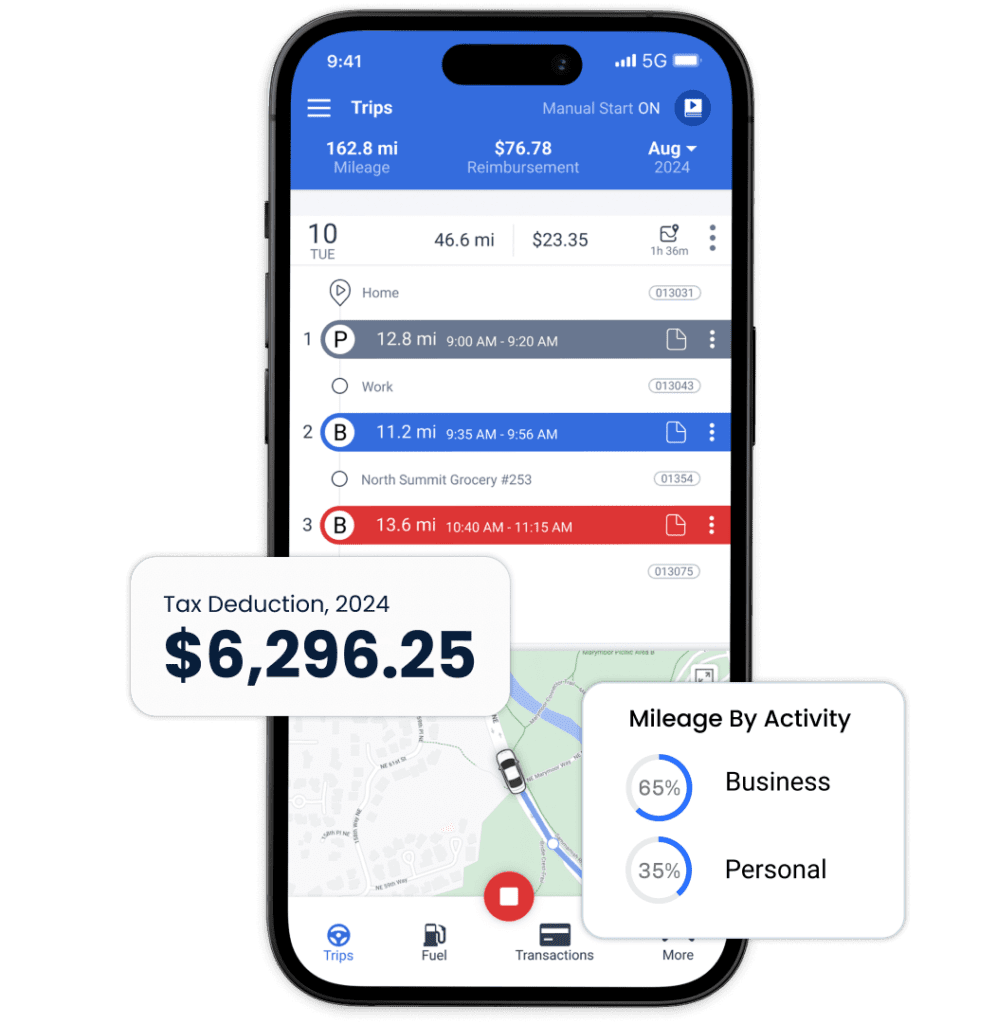

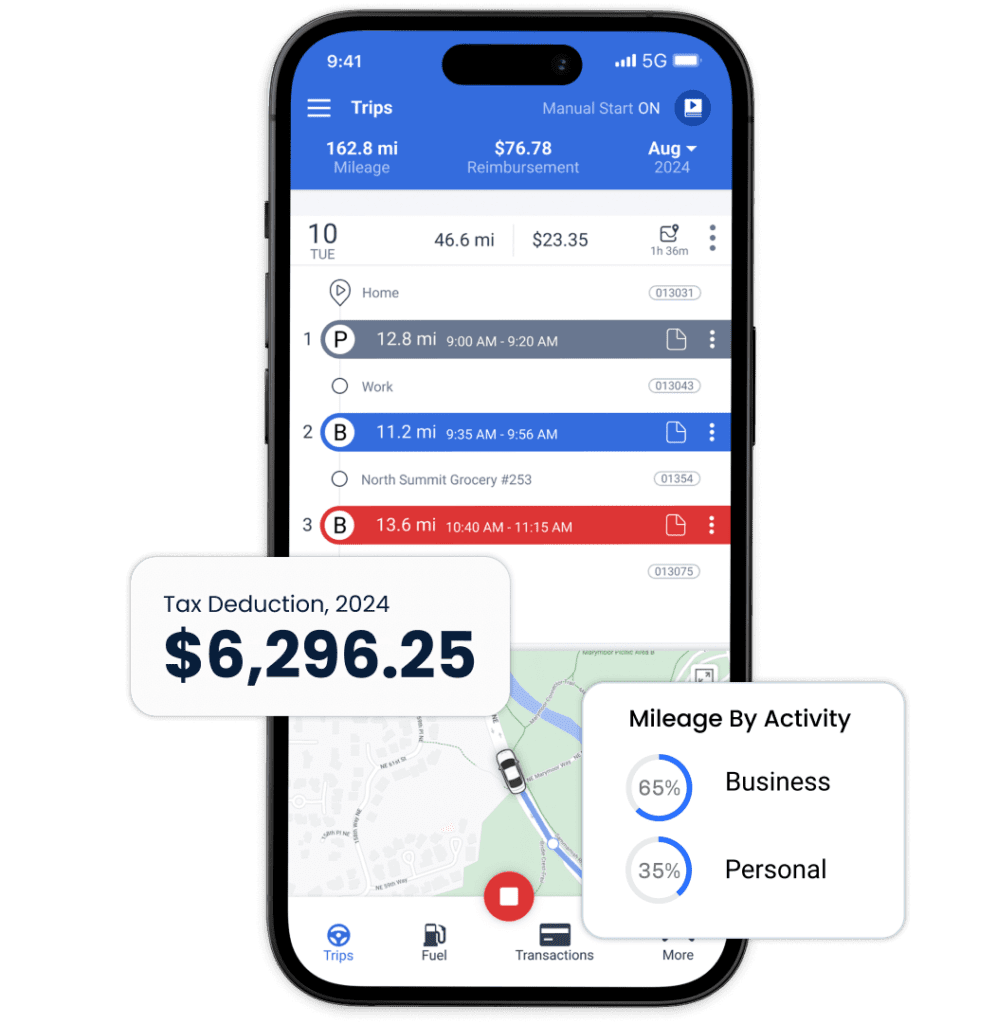

Easy Trip Classification

With just one easy swipe in the TripLog mileage tracker app, you can classify your drives as business or personal. You can also set work hours to automatically classify your trip based on your schedule.

Tax Compliant Mileage Reports

TripLog’s mileage tracker gives drivers detailed reports straight from the app. See how much you’re driving, spending, and earning back.

Trusted by Fortune 100 companies and over 500,000 users worldwide.