Starting your own business is no easy task. You often have to navigate unfamiliar territory just to track your business expenses and reach your customers. Then, when it comes time to pay taxes, you’re hit with seemingly every tax known to man. This might leave you thinking, “I owe HOW MUCH?”

Luckily, there are a wide variety of business expenses that you can deduct to reduce your tax burden, but knowing just how and when you can deduct can be tricky. If you’re here, you probably already know that you can deduct business related mileage on your car, but there are so many other ways to save. That’s why we created a list of the 10 Most Common Tax Deductions for Small Businesses.

It’s never too early to get a head start on tracking your tax deductions. There are many great tools and resources to help you get started. TripLog helps you track your business mileage and expenses and organizes them in an easy-to-read, IRS compliant report, so you can maximize your tax deductions and peace of mind. Get started with your 30-day free trial today and watch the savings add up. We’ll be there every step of the way to cheer you on!

Did you miss our last post? Check it out to see how TripLog got it’s start and meet our Founder, Ted He.

——————————————————————————————————————————————————————————————–

Infographic Transcription:

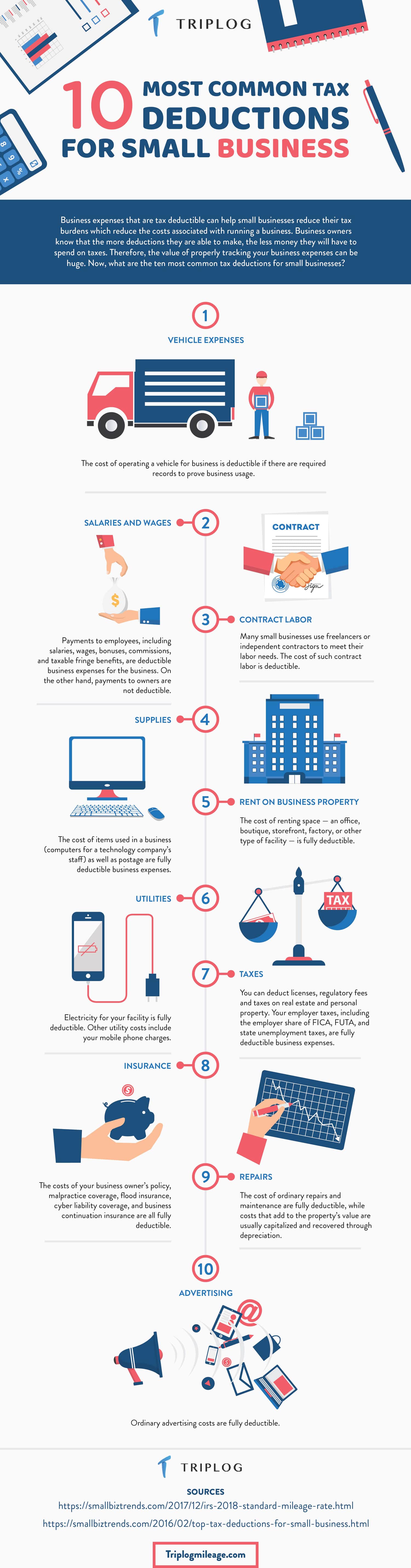

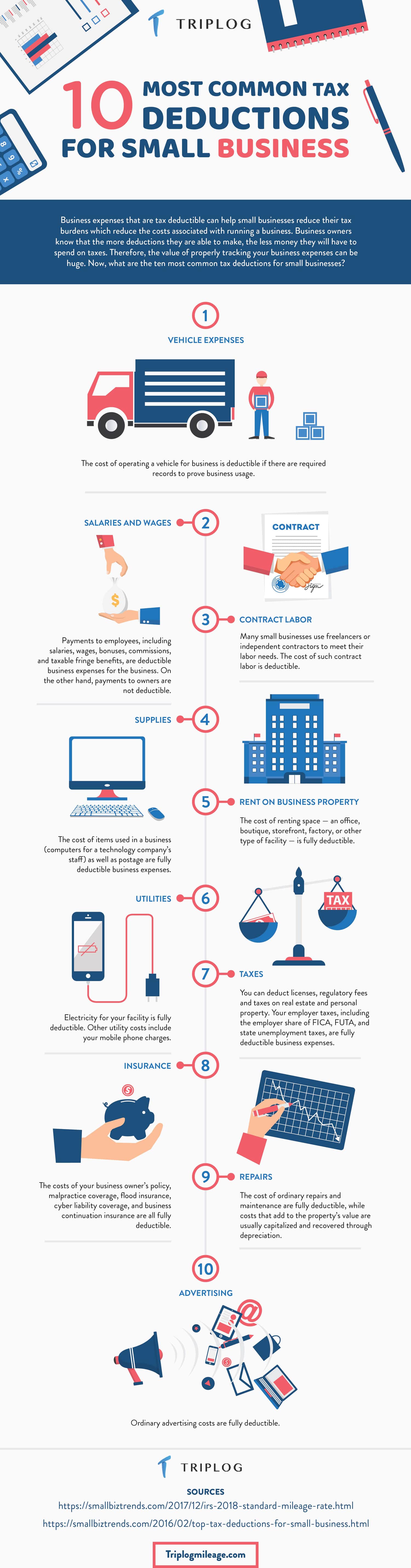

Business expenses that are tax deductible can help small businesses reduce their tax burdens which reduce the costs associated with running a business. Business owners know that the more deductions they are able to make, the less money they will have to spend on taxes. Therefore, the value of properly tracking your business expenses can be huge. Now, what are the ten most common tax deductions for small businesses?

It’s never too early to get a head start on tracking your tax deductions. There are many great tools and resources to help you get started. TripLog helps you track your business mileage and expenses and organizes them in an easy-to-read, IRS compliant report, so you can maximize your tax deductions and peace of mind. Get started with your 30-day free trial today and watch the savings add up. We’ll be there every step of the way to cheer you on!

Did you miss our last post? Check it out to see how TripLog got it’s start and meet our Founder, Ted He.

——————————————————————————————————————————————————————————————–

Infographic Transcription:

Business expenses that are tax deductible can help small businesses reduce their tax burdens which reduce the costs associated with running a business. Business owners know that the more deductions they are able to make, the less money they will have to spend on taxes. Therefore, the value of properly tracking your business expenses can be huge. Now, what are the ten most common tax deductions for small businesses?

It’s never too early to get a head start on tracking your tax deductions. There are many great tools and resources to help you get started. TripLog helps you track your business mileage and expenses and organizes them in an easy-to-read, IRS compliant report, so you can maximize your tax deductions and peace of mind. Get started with your 30-day free trial today and watch the savings add up. We’ll be there every step of the way to cheer you on!

Did you miss our last post? Check it out to see how TripLog got it’s start and meet our Founder, Ted He.

——————————————————————————————————————————————————————————————–

Infographic Transcription:

Business expenses that are tax deductible can help small businesses reduce their tax burdens which reduce the costs associated with running a business. Business owners know that the more deductions they are able to make, the less money they will have to spend on taxes. Therefore, the value of properly tracking your business expenses can be huge. Now, what are the ten most common tax deductions for small businesses?

It’s never too early to get a head start on tracking your tax deductions. There are many great tools and resources to help you get started. TripLog helps you track your business mileage and expenses and organizes them in an easy-to-read, IRS compliant report, so you can maximize your tax deductions and peace of mind. Get started with your 30-day free trial today and watch the savings add up. We’ll be there every step of the way to cheer you on!

Did you miss our last post? Check it out to see how TripLog got it’s start and meet our Founder, Ted He.

——————————————————————————————————————————————————————————————–

Infographic Transcription:

Business expenses that are tax deductible can help small businesses reduce their tax burdens which reduce the costs associated with running a business. Business owners know that the more deductions they are able to make, the less money they will have to spend on taxes. Therefore, the value of properly tracking your business expenses can be huge. Now, what are the ten most common tax deductions for small businesses?

- Vehicle Expenses

- Salaries and wages

- Contract labor

- Supplies

- Rent on business property

- Utilities

- Taxes

- Insurance

- Repairs

- Advertising

2018 Standard Mileage Rate Goes Up, IRS Announceshttps://smallbiztrends.com/2016/02/top-tax-deductions-for-small-business.html [mc4wp_form id=”9800″]